Increased client activity fuels Marex revenues in H1 2022

Marex today announced a set of strong results for the six months to 30 June 2022. Recent strategic investment across the global franchise has positioned the business to outperform in favourable market conditions, driving organic revenue growth, increased profit and improved margins and ROE.

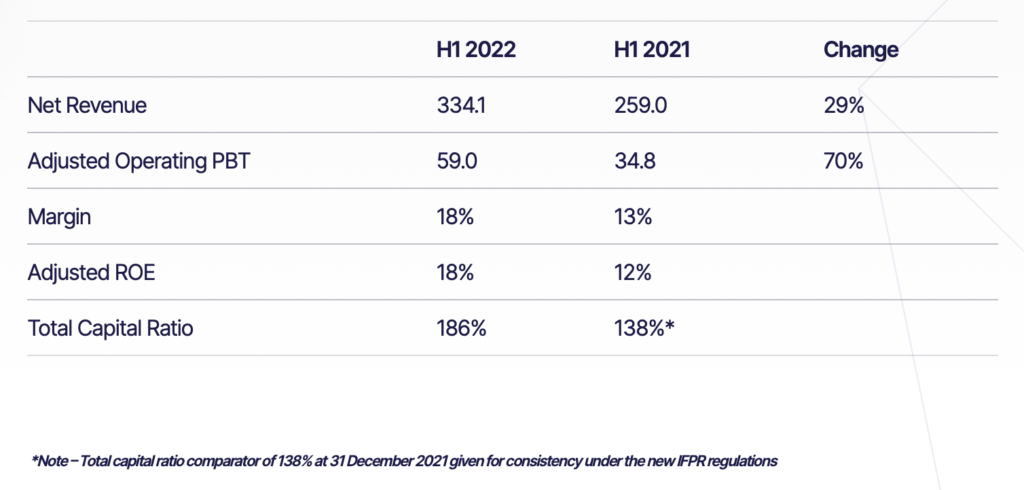

Net revenue increased 29% year-on-year to $334 million due to increased client activity on the platform and very strong performance in Marex’s Market Making and Execution and Clearing businesses.

Market Making revenues increased 84% to $101 million (2021: $55 million), as energy and commodities markets saw increased prices and elevated volatility during the period, particularly in Q1.

Execution and Clearing revenues increased 36% to $117 million (2021: $86 million) benefiting from higher volumes (+4% YoY), several notable new clients joining the platform combined with a positive market environment which allowed re-pricing of risk and higher interest income which increased $7 million YoY.

Hedging and Investment Solutions revenues were broadly stable compared to the prior year, at $44 million due to broader market volatility across most asset classes impacting investor appetite and demand for Marex’s financial investment solutions.

Price Discovery revenues were broadly stable at $69 million (2021: $68 million), with solid demand for Marex’s liquidity provision services during the period – despite significant volatility and disruption in the European energy markets which led to reduced activity in the second quarter.

Adjusted Operating PBT increased 70% year-on-year to $59 million, reflecting successful organic growth and higher interest income.

Ian Lowitt, Marex CEO, commented:

“I am extremely pleased to report another record half year result, which demonstrates the earnings power of our franchise against the strong comparative periods of 2021 and 2020, which benefited from Covid-related volatility.

I am proud of how our business has successfully navigated the recent market volatility, which at times has been extremely challenging, continuing to provide liquidity and support to our clients. This performance also underlines how our growth strategy of investing to increase the range of what we can offer our clients, whilst also diversifying the firm, is bearing fruit – and how profitable we can be when supported by macroeconomic tailwinds”.

Marex announced on 1 August that it had agreed to acquire ED&F Man Capital Markets, the financial services division of ED&F Man Group. ED&F Man Capital Markets has approximately 450 employees globally and generated over $235 million of revenues in 2021.

The transaction is expected to complete by the end of the year, subject to regulatory approvals.