HSBC reports 82% Y/Y jump in profit in Q1 2021

HSBC Holdings plc (LON:HSBA) today posted its financial results for the first three months of 2021, with profits staging a steep rise.

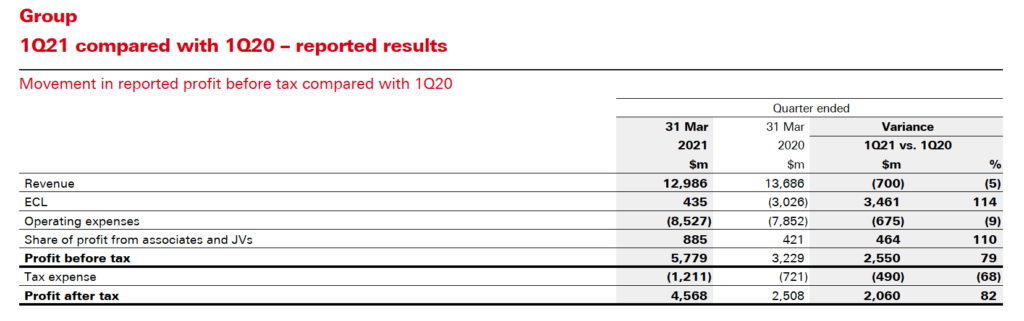

For the first quarter of 2021, reported profit after tax was $4.6 billion, up 82% from the result recorded in the equivalent quarter a year ago, while reported profit before tax was $5.8 billion, up 79% year on year.

Reported revenue for the first quarter of 2021 amounted to $13.0 billion, 5% lower than a year earlier. The reduction primarily reflected a fall in net interest income as a result of the impact of lower global interest rates, notably affecting HSBc’s deposit franchises in WPB and in Global Liquidity and Cash Management (‘GLCM’) in CMB and GBM.

In Markets and Securities Services, revenue increased by $0.1bn or 6% due to favourable movements in credit and funding valuation adjustments of $0.4bn and as 1Q20 included a $310m adverse bid-offer adjustment. Revenue in Global Debt Markets and Equities increased, particularly in wealth and private credit, reflecting robust client activity.

These increases more than offset lower revenue in Global Foreign Exchange, which was in the context of a particularly strong performance in 1Q20. Securities Services revenue fell by $0.1bn or 14% due to lower interest rates, notably in Asia and Europe, while fees were up 6%, mainly in Asia.

The Group will not pay quarterly dividends during 2021 but will consider whether to announce an interim dividend at the 2021 half-year results in August. HSBC will review whether to revert to paying quarterly dividends at or ahead of its 2021 results announcement in February 2022.

On 23 February 2021, the Directors approved an interim dividend for 2020 of $0.15 per ordinary share. The interim dividend will be payable on 29 April 2021 in cash in US dollars, or in sterling or Hong Kong dollars at exchange rates determined on 19 April 2021.