HSBC registers 16% Y/Y rise in Global Markets revenues in Q3 2020

HSBC Holdings plc (LON:HSBA) today posted its financial report for the third quarter and the first nine months of 2020.

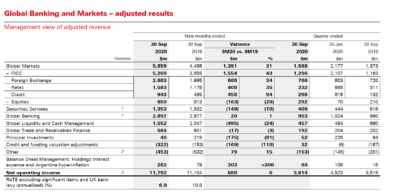

Global Markets delivered solid performance, as shown by the results. In the third quarter of 2020, Global Banking and Markets registered adjusted profit before tax of $1.2 billion, unchanged compared with the third quarter of 2019.

Global Banking and Markets adjusted revenue was $0.1 billion or 3% higher, reflecting a $0.2 billion or 16% increase in Global Markets, as ongoing market volatility resulted in an improved performance in FICC, and from favourable movements in credit and funding valuation adjustments of $0.2bn. This increase was partly offset by the impact of lower global interest rates, leading to a reduction of $0.2 billion in Global Liquidity and Cash Management (GLCM) and $0.1 billion in Securities Services.

The increase in adjusted revenue was largely offset by higher adjusted expected credit losses (ECL), which rose by $80 million to $100 million, from higher charges against specific customers and provisions relating to the Covid-19 outbreak, although adjusted operating expenses remained broadly unchanged.

In the first nine months of 2020, Global Banking and Markets registered adjusted profit before tax of $3.8 billion, $0.2bn lower than in the corresponding period a year earlier, mainly due to higher adjusted ECL, which reflected the global impact of the Covid-19 outbreak and included charges relating to specific exposures. The rise in adjusted ECL was partly offset by higher adjusted revenue and from lower adjusted operating expenses.

Global Banking and Markets saw adjusted revenue of $11.8 billion in the first nine months of 2020, up $0.7 billion from a year earlier.

In Global Markets, revenue in the first nine months of 2020 increased by $1.4 billion or 31%, as higher volatility levels supported an improved FICC performance, particularly in Credit, in both primary and secondary markets, and in Forex. Rates also had a strong performance due to increased trading activity in government bonds.

Across all segments, reported profit after tax for the third quarter of 2020 was $2.0 billion, down 46% from a year earlier. Reported profit before tax of $3.1 billion was36% lower, primarily reflecting a reduction in reported revenue.

Reported revenue fell mainly from the impact of lower interest rates on HSBC’s deposit franchises, and lower share of profit from its associate SABB, reflecting the share of an impairment of the goodwill it recognised on the completion of the merger with Alawwal bank in 2019. These factors were in part offset by lower reported operating expenses and a reduction in reported ECL. favourable). Reported revenue for the third quarter of 2020 was $11.9 billion, down 11% from the third quarter of 2019. The reduction primarily reflected lower net interest income as a result of the progressive impact of lower interest rates across HSBC’s major markets, notably affecting its deposit franchises in WPB and in Global Liquidity and Cash Management in Commercial Banking and GBM.

In addition, 3Q20 included restructuring and other related costs of $0.1bn associated with disposal losses related to the RWA reduction commitments HSBC made at its business update in February 2020. HSBC expects to incur additional disposal losses in future quarters as it progresses with these reductions.

Regarding dividend, Noel Quinn, Group Chief Executive, said:

“The Group’s capital and liquidity ratios strengthened further in the quarter despite the challenging economic conditions. A decision on whether to pay a dividend for the 2020 financial year will depend on economic conditions in early 2021, and be subject to regulatory consultation. We will seek to pay a conservative dividend if circumstances allow.”