Exclusive: Tavira Financial sees 22% jump in FY2023 Revenue to £29.4M

FNG Exclusive… FNG has learned that London based, FCA regulated agency broker and execution specialist (and budding CFDs broker) Tavira Financial saw a healthy increase in activity in FY 2023 (year ended March 31, 2023), reporting a 22% increase in Revenues, at £29.4 million versus £24.0 million in 2022. (And that follows a 48% Revenue increase from 2o21-2022 at Tavira).

However increased costs led Tavira to post a slight net loss for the year of £126K, versus profit of £423K last year.

Tavira Financial was founded in 2005 and is still run by controlling shareholder and CEO Eliot Goodfellow, who was previously Refco’s Head of Equity Derivatives. The company acts as an agency broker and investment manager specialising in global execution and investment management. We reported last year that the company hired longtime FX industry executive Andrew Gibson, to help Tavira build an FX and CFDs brokerage business out of Dubai.

The principal activity of Tavira Financial is that of an agency broker specialising in global execution services for both equities and derivatives. The company is authorised and regulated by the UK’s Financial Conduct Authority.

In September 2022, Tavira Securities Ltd changed its name to Tavira Financial Ltd. The company said that this was to more accurately reflect the broad range of products and services on offer within the Tavira Group, and enhance the company’s brand within an already competitive marketplace. Such rebranding proved successful, resulting in a 22% increase in gross revenue year on year, as per above.

Tavira said that this increase can be attributed to growth in Fixed Income (+264%), Custody & Clearing (+106%), and Corporate Broking (+477%). Even though results have benefitted from reporting 12 months of Corporate Broking revenues, compared to 3 months in the prior year, the embedding of the team has coincided with numerous capital raises on behalf of established clients.

The company noted that it saw a reduction in some product lines within traditional brokerage revenues, but overall brokerage remains a stable source of income for the Group.

Unfortunately, Tavira’s asset management business has suffered due to the savings and investment landscape. Improved interest rates have lured investors to other more attractive opportunities, in the short term at least, but this phenomenon is not isolated to Tavira.

On a more positive note, in November 2002 Tavira launched the Perspective American Absolute Alpha UCITS Fund, led by Stephen Moore, formerly of Artemis and Threadneedle. Initial subscriptions and performance have been encouraging, to such an extent that in July 2023 he will be opening his second fund, Perspective American Extended Alpha UCITS Fund.

Even though costs have increased in line with revenues, the company said that the overall review of the financial year is positive. Tavira’s Sydney based Australian branch continues to grow, both in revenue and broker headcount; whilst the London office has expanded the brokerage and Corporate Broking services and client base through further recruitment.

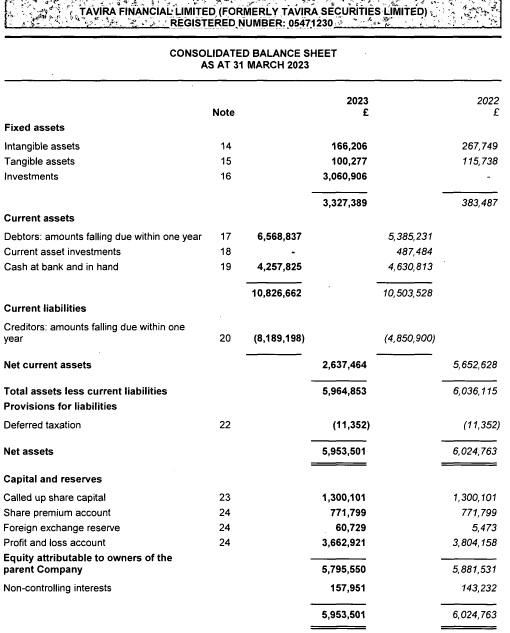

Tavira’s 2023 income statement and balance sheet follow.