Euroclear marks increase in net profit in Q1 2023

Euroclear today posted its financial report for the first quarter of 2023.

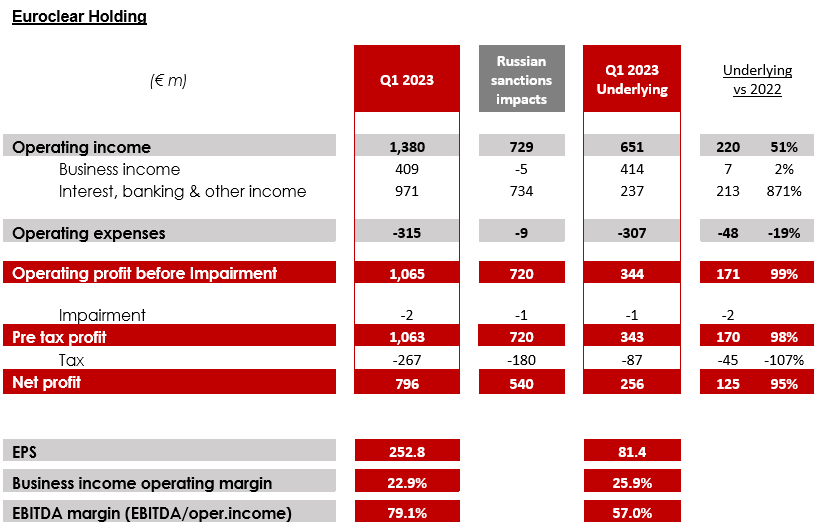

In total, Q1 2023 net profit increased to EUR 796 million, benefitting from the continued delivery on the group’s strategy and its resilient business model.

Underlying Q1 operating income rose 51% to a record EUR 651 million.

Most of the group’s operating income came from products and services that generated fees. Business income improved through the quarter to reach a record EUR 414 million, an increase of 2% year-on-year.

The Euroclear group’s business model provides a hedge against market volatility. When equity markets are lower, the impact is mitigated by the group’s diversified and subscription-like business model, and we benefit in a similar vein when bond markets are weaker, as approximately three quarters of the group’s business income is decoupled from financial market valuations. Such that, in the recent market environment, when both equity valuations and transaction volumes have been low, any potential impact to Euroclear has been mitigated by those operating entities which have a greater relative weighting to the bond markets, which saw business income grow.

Over a three-year period, underlying business income has grown 9% CAGR, reflecting the robust growth delivered by the strategy through volatile financial market conditions.

Since last year, the interest rate environment has changed dramatically. This has resulted in a large increase in interest earnings due to rising interest rates on cash balances. On an underlying basis, Q1 2023 interest, banking and other income increased by 871% to EUR 237 million because of rising interest rates.

Euroclear is investing in its strategy, leading to underlying operating expenses increasing to EUR 307 million, up 19% compared to the prior year.

Approximately 10% of the increase in underlying operating expenses is due to inflation on costs, with the remainder reflecting continued investments in its technology and service offering, as well as one-off projects. The investments in Euroclear’s technology aim at enhancing Euroclear’s client proposition, business resilience, and to increase efficiency through standardisation and modernisation.

Euroclear continues to expect expenditure to remain above its ‘through-the-cycle’ target of 4-6% p.a. throughout 2023, due to accelerating investment in both its strategy and the resilience of the business, coupled with continued inflationary pressures on the cost base. Excluding the impact of inflation and one-off expenditures, Euroclear’s Q1 expense profile is broadly in line with the top end of the through-the-cycle range.

Nevertheless, profitability has continued to rise, as expected, as inflation headwinds have been more than offset by higher net interest income from subsequent rate increases. The group’s underlying EBITDA margin was 57% in the first quarter, a level which is amongst the industry leaders in the financial market infrastructure sector.

On an underlying basis, earnings per share almost doubled, up 95% to EUR 81.4 per share.

The group maintains a strong capital position and a low-risk profile, which are critical as a financial market infrastructure and create headroom for further growth.