Euroclear books net profit of EUR 351 million in H1 2022

Euroclear today provided an update on its performance in the first half of 2022.

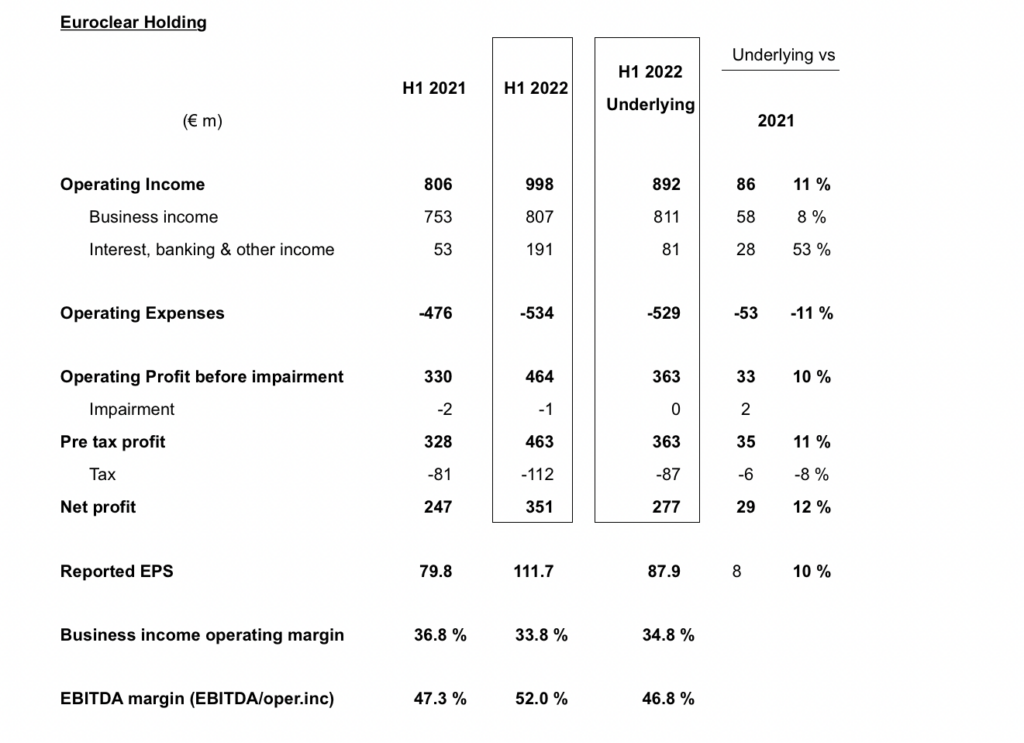

Euroclear delivered a strong financial performance in H1 2022, with the underlying business continuing to perform well. Euroclear also reported higher interest earnings due to rising interest rates on cash balances.

Net profit increased 42% to EUR 351 million, of which EUR 277 million resulted from the strong underlying business performance.

Euroclear continues to see very strong demand for collateral management and lending services from a broad range of market participants. Since 2016, structural demand has been driven by the introduction of the Uncleared Margin Rules (UMR) under Basel III as more participants were require to adopt collateral management services to reduce the risk of derivatives exposures. The fifth wave of the UMR came into force last year.

In the second quarter, Euroclear launched a new ESG reporting solution for asset managers, through the combination of MFEX by Euroclear and Greenomy, two recent investments. In addition to illustrating the benefits of the expanded product offering, the new service demonstrates Euroclear’s increased strategic focus on Sustainable Finance.

The integration of MFEX is progressing according to plan as MFEX’s established fund distribution platforms are combined with Euroclear’s post-trade expertise to create a new end-to-end funds offering.

The group also continues to modernise its legacy technology infrastructure, including the domestic CSDs.

The Board confirms its intention to pay its previously announced dividend of EUR 88.5 per share (equating to a total of EUR 279 million) in the fourth quarter of 2022.