Deutsche Bank registers growth in Fixed Income & Currency trading revenues in Q4 2020

Deutsche Bank AG (ETR:DBK) today posted its financial report for the final quarter of 2020.

For the full year 2020, Deutsche Bank recorded profit of EUR 624 million, with pre-tax profit of EUR 1.0 billion, versus a loss of EUR 5.3 billion, and a loss before tax of EUR 2.6 billion, in 2019.

For the fourth quarter of 2020, Group profit was EUR 189 million, versus a loss of EUR 1.5 billion in the fourth quarter of 2019. Pre-tax profit was EUR 175 million, compared to a EUR 1.3 billion loss before tax in the prior year quarter.

Full year 2020 Group net revenues rose 4% to EUR 24.0 billion, whereas fourth quarter Group net revenues grew 2% to EUR 5.5 billion.

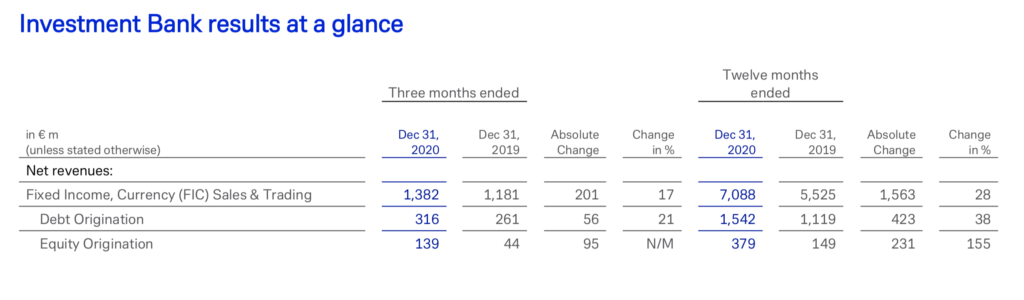

Investment Bank’s net revenues for the fourth quarter of 2020 were EUR 1.9 billion, up 24% year-on-year and up 28% ex-specific items. Revenue growth was driven by sustained good client flows underpinned by favorable market conditions.

Fixed Income & Currency (FIC) Sales & Trading revenues of EUR 1.4 billion grew by 17%, and by 21% ex-specific items, the fifth consecutive quarter of year-on-year revenue growth. Growth in Foreign Exchange revenues was driven by elevated volatility and strength in derivatives. Let’s note that the FIC segment delivered robust results in Q3 2020 too.

For the full year 2020, the Investment Bank segment reported profit before tax of EUR 3.2 billion compared to EUR 502 million in 2019. Adjusted profit before tax was EUR 3.3 billion, up more than three-fold compared to EUR 929 million in the prior year. This increase was driven by significantly higher revenues and reductions in adjusted costs, which more than offset a rise in provision for credit losses resulting from COVID-19.

FIC Sales & Trading revenues were up 28% to EUR 7.1 billion in the full year 2020, driven by strong growth in Rates, Emerging Markets and FX.

Christian Sewing, Chief Executive Officer, said:

“In the most important year of our transformation, we were able to more than offset transformation-related effects and elevated credit provisions – despite the global pandemic. With profit before tax of a billion euros, we’re ahead of our own expectations. We have built firm foundations for sustainable profitability, and are confident that this overall positive trend will continue in 2021, despite these challenging times.”