Credit Suisse posts net loss of CHF353m in Q4 2020

Credit Suisse Group AG (SWX:CSGN) today reported its financial results for the final quarter of 2020. In line with earlier forecasts, the Group posted a loss for the final three months of 2020.

Credit Suisse absorbed several items during the quarter that had a considerable impact on the reported numbers. These included major litigation provisions of CHF 757 million, restructuring and real estate disposal expenses of CHF 78 million, a net adverse impact on its pre-tax income of CHF 108 million from FX moves, as well as a number of significant items, including an impairment to the valuation of the non-controlling interest in York of CHF 414 million, the CHF 158 million gain related to the equity investment revaluation of SIX and the CHF 127 million gain related to the equity investment revaluation of Allfunds Group.

As a consequence, the Group reported a pre-tax loss in the final quarter of 2020. The pre-tax loss was CHF 88 million, and the net loss attributable to shareholders was CHF 353 million.

Net revenues of CHF 5.2 billion were down 16% year on year, while total operating expenses of CHF 5.2 billion increased 7%.

Adjusted pre-tax income, excluding significant items, was CHF 861 million in the fourth quarter of 2020, down 10% year on year and adjusted net revenues, excluding significant items, were CHF 5.3 billion, down 4%.

Credit Suisse’s Wealth Management-related businesses reported net revenues of CHF 3.1 billion, down 24% year on year, with transaction-based revenues up 7%, lower recurring commissions and fees, down 6% and lower net interest income, down 14%. Adjusted total Wealth-Management-related net revenues, excluding significant items and at constant FX rates, of CHF 3.4 billion were down 2% year on year, with strong transaction-based revenues, up 15%, stable recurring commissions and fees, and lower net interest income, down 11%.

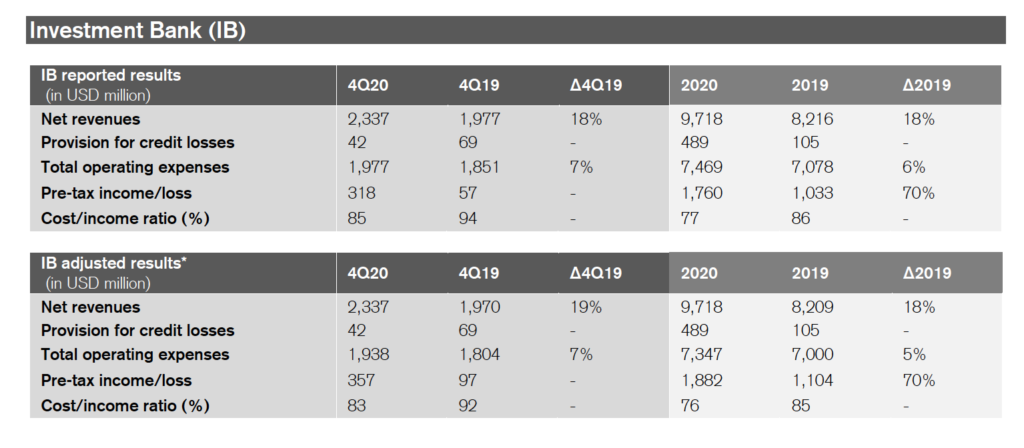

Credit Suisse’s global investment banking revenues increased to USD 2.5 billion, up 19% year on year, benefitting from a resilient performance across products: Fixed Income Sales & Trading was flat year on year, Equity Sales & Trading was up 5%, and Capital Markets & Advisory12 was up 63%.

Credit Suisse recorded CHF 138 million provision for credit losses, compared to CHF 94 million in 3Q20, driven by higher net provisions across SUB, IWM and IB.

The Board of Directors will propose to the shareholders at the Annual General Meeting on April 30, 2021 a cash distribution of CHF 0.2926 per share for the financial year 2020. This is in line with Credit Suisse’s intention to increase the ordinary dividend per share by at least 5% per annum.

The Group explains that 50% of the distribution will be paid out of capital contribution reserves, free of Swiss withholding tax and not be subject to income tax for Swiss resident individuals holding the shares as a private investment, and 50% will be paid out of retained earnings, net of 35% Swiss withholding tax.