Credit Suisse posts $1.6bn net loss for FY21 as Archegos matter hits earnings

Credit Suisse today posted its financial results for the final quarter and full year 2021, with its performance heavily affected by the Archegos matter.

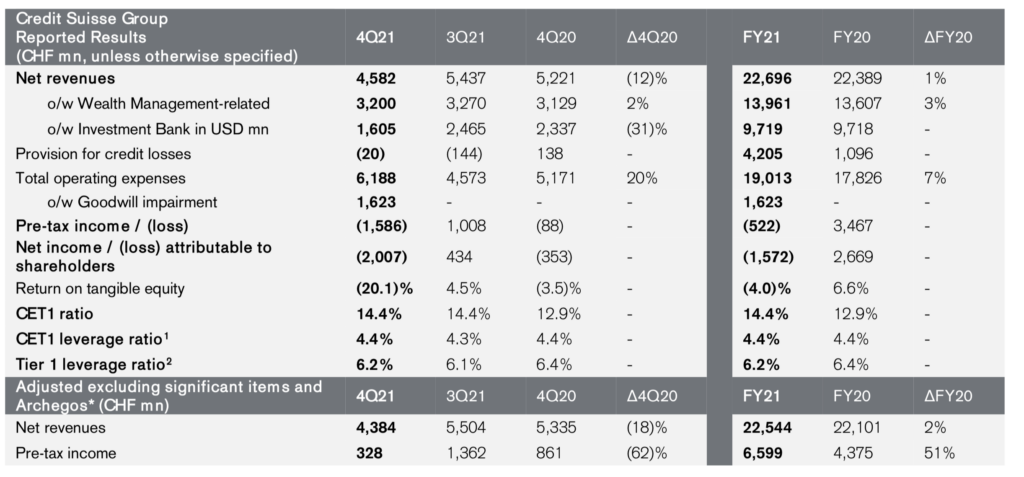

For the full year 2021, Credit Suisse reported pre-tax loss of CHF 522 million, down significantly year on year, compared to pre-tax income of CHF 3.5 billion in FY20. FY21 included gains made on Credit Suisse’s equity investment in Allfunds Group of CHF 602 million as well as gains on real estate sales of CHF 232 million.

Results in FY21 were affected by the impact of CHF 4.8 billion relating to Archegos, CHF 1.6 billion in the form of a goodwill impairment, CHF 1.1 billion relating to major litigation provisions, a CHF 113 million impairment related to the valuation of its non-controlling interest in York Capital Management and CHF 103 million of restructuring costs.

On an adjusted basis, excluding significant items and Archegos, FY21 pre-tax income would be CHF 6.6 billion, up 51% year on year.

Compared to the exceptional levels of 1Q21, Credit Suisse has seen a reversion to lower, pre-pandemic levels of business activity, particularly given the monetary tightening that central banks have initiated. Credit Suisse also expects its Equities revenues to be impacted by the exit from Prime Services.

However, after a weak start to the year, Credit Suisse is seeing encouraging signs of improving franchise momentum, including positive net new asset inflows year-to-date in its Wealth Management business.

As previously highlighted at its Investor Day on November 4, 2021, the year 2022 will be a transition year for Credit Suisse as the benefits of its strategic capital reallocation towards core businesses and generating structural costs savings to invest for growth should largely materialize from 2023 onwards. In this context, the results for 2022 are expected to be adversely affected by restructuring costs and higher compensation costs compared to last year.

Credit Suisse’s reported results are expected to also reflect volatility in the share price of its 8.6% holding in Allfunds Group (the value of which has declined by CHF 204 million so far in 2022). During 2022, Credit Suisse intends to meet its goal of releasing a cumulative USD 3 billion of allocated capital from its Investment Bank for reinvestment into Wealth Management and other core businesses.