CME to include Options on Eurodollar Futures in portfolio margin program with IRS products

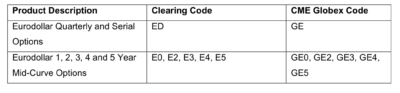

CME Clearing reminds market participants that it plans to expand its portfolio margining offering for IRS Products to include several Options on Eurodollar Futures in addition to existing eligible Futures products: Eurodollar Futures, Fed Funds Futures, Treasury Futures and Deliverable Swap (MAC) Futures.

This expansion is scheduled to be enabled in the Production environment on December, 2020, subject to regulatory approval.

There will be no impact to Initial Margin methodology/numbers for existing set of Swaps/products cleared under IRS Guaranty Fund. Note that the margin number will vary if any Options positions are included in portfolio margining.

• Support for Listed Options in portfolio margining in CME Clearing system

- Exercise and Assignment operations

- Available Net Option Value settlement

In conjunction with CME expanding the Portfolio Margin program to include Options on Eurodollar Futures, CME is releasing a new build of the Optimizer software, version 15.

Optimizer users must upgrade to the newest build by the production deadline December 7, 2020. Firms that do not upgrade on the production deadline will experience subsequent Optimizer failures.

Note that the inclusion of Listed Options has been available for testing in CME’s test environment since October 28, 2020.