Citigroup marks 13% Y/Y rise in Markets & Securities Services revenues in Q4 2020

Citigroup Inc (NYSE:C) today posted its key financial results for the fourth quarter of 2020.

Citigroup registered revenues of $16.5 billion in the fourth quarter 2020, down 10% from a year earlier, primarily reflecting the lower revenues in Global Consumer Banking (GCB), Institutional Clients Group (ICG), and Corporate / Other.

Citigroup net income of $4.6 billion in the fourth quarter 2020 declined 7% from a year earlier due to the lower revenues, the higher expenses, and a higher effective tax rate, partially offset by the lower cost of credit.

Citigroup’s allowance for credit losses on loans was $25.0 billion at quarter end, or 3.73% of total loans, compared to $12.8 billion, or 1.84% of total loans, at the end of the prior-year period. Total non-accrual assets grew 40% from the prior-year period to $5.7 billion. Consumer non-accrual loans increased 18% to $2.1 billion, while corporate non-accrual loans of $3.5 billion increased 61% from the prior-year period.

During the final quarter of 2020, Citigroup returned a total of $1.1 billion to common shareholders in the form of dividends.

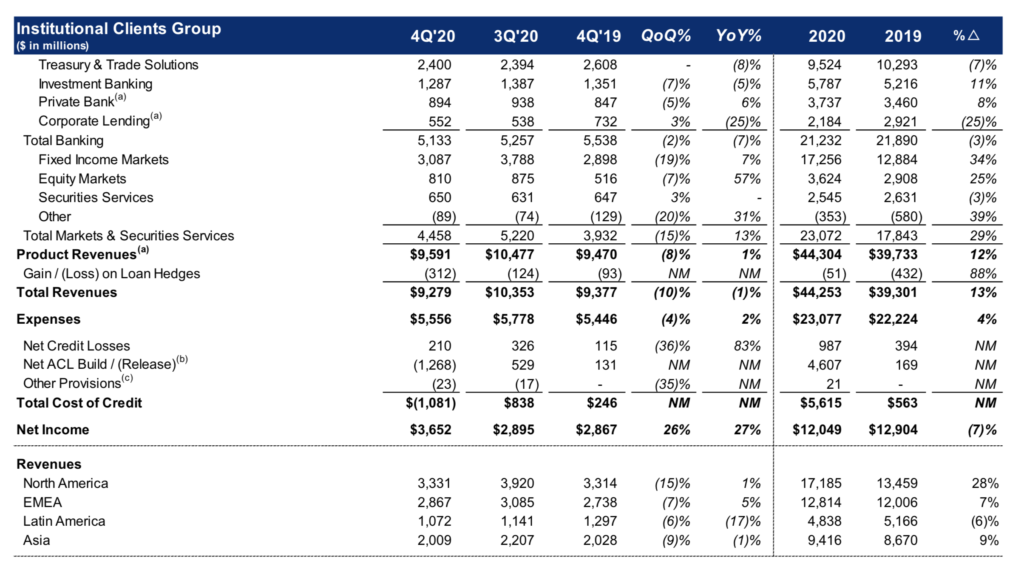

Let’s note the Institutional Clients Group (ICG) financial performance metrics. ICG revenues of $9.3 billion decreased 1%, reflecting lower revenues in Treasury and Trade Solutions, Investment Banking, and Corporate Lending, nearly offset by strength in Fixed Income Markets, Equity Markets and the Private Bank.

Markets and Securities Services revenues of $4.5 billion increased 13% from a year earlier. Fixed Income Markets revenues of $3.1 billion increased 7%, as higher revenues across spread products and commodities were partially offset by lower revenues in rates and currencies.

Equity Markets revenues of $810 million increased 57%, driven by strong performance in cash equities, derivatives, and prime finance, reflecting strong client volumes and more favorable market conditions.

Securities Services revenues of $650 million were unchanged on a reported basis, but up 2% in constant dollars, as higher deposit and settlement volumes and growth in assets under custody were partially offset by lower spreads.

ICG net income amounted to $3.7 billion in the final quarter of 2020, marking an increase of 27% from the year-ago quarter, as the lower cost of credit more than offset the decline in revenues and higher expenses.