BNP Paribas registers steep rise in Global Markets revenues in Q3 2020

BNP Paribas SA (EPA:BNP) today posted its financial results for the third quarter of 2020, with Global Markets segment showing some solid performance.

Global Markets revenues, at 1,711 million euros, rose sharply, by 31.8% compared to the third quarter 2019, on the back of high client volumes. The quarter featured very strong growth at Fixed Income, Currencies and Commodities (FICC), as well as Equity and Prime Services.

VaR (1 day, 99%), which measures the level of market risks, came to 46 million euros on average. It was lower compared to its late March peak, when it exceeded 70 million euros, due to the volatility shock on the markets, but was still higher than its 2019 low point.

Global Markets showed strong activity in a normalising environment with a good level of client activity on the rate and Forex markets, boosted by greater market shares, and in the equity markets, in both derivatives and prime brokerage.

The prime brokerage business continued to implement the agreement with Deutsche Bank in line with the established schedule, and to develop strategic partnerships, for example with NatWest Markets for the provision of execution and clearing of listed derivatives.

FICC (Fixed Income, Currencies and Commodities) revenues, at 1,245 million euros, were up sharply (+36.0%) compared to the third quarter 2019 and rose in all businesses, particularly in currencies and commodities, and in all regions, in particular emerging markets. On the primary market, FICC achieved a high level of bond issuance in the third quarter 2020, in line with the 2019 level, and was ranked no.1 for bonds in euros.

Equity and Prime Services revenues, at 466 million euros, were up by 21.4% compared to the third quarter 2019, as a result of strong client activity in derivatives, in particular in the United States, and a steady increase in Prime Services.

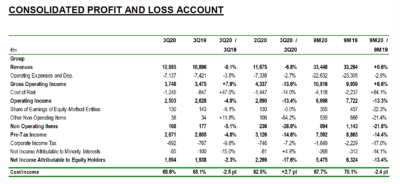

Across all segments, revenues, at 10,885 million euros, were stable (-0.1%) compared to the third quarter 2019 at historical scope and exchange rates, and were up by 2.1% at constant scope and exchange rates.

Pre-tax income amounted t 2,671 million euros in the third quarter of 2020, down 4.8% from the result of 2,805 million euros registered in the third quarter 2019.

The Group’s net income attributable to equity holders thus totalled 1,894 million euros in the third quarter of 2020, down 2.3% compared to the third quarter 2019. When excluding exceptional items, it came to 1,940 million euros, down by 8.3%.