BGC Group registers 31% Y/Y increase in FX revenues in Q1 2025

BGC Group, Inc. (NASDAQ:BGC) today reported its financial results for the quarter ended March 31, 2025.

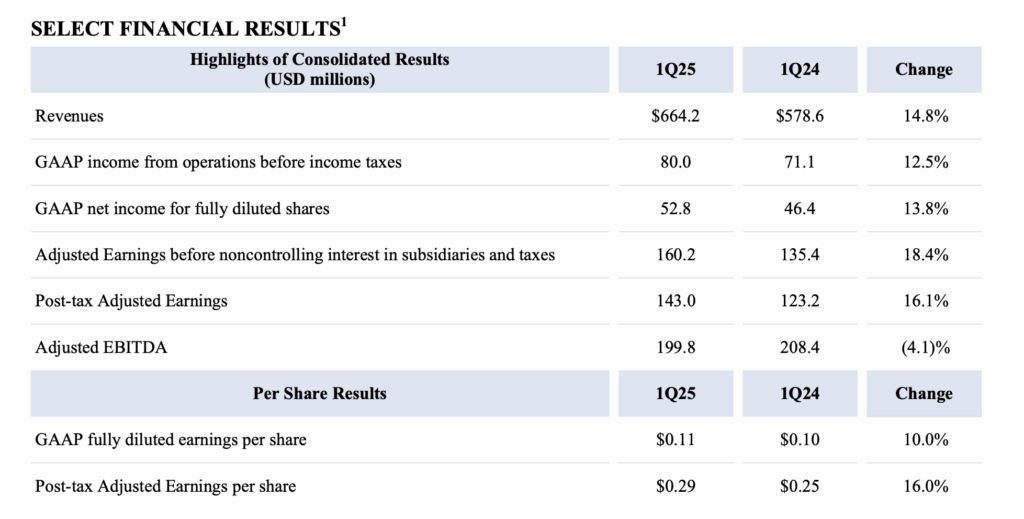

The Group registered record first quarter revenues of $664.2 million, a 14.8% increase versus the equivalent period last year.

Total brokerage revenues grew by 15.7% in the first quarter of 2025.

Foreign Exchange revenues were up 31% to a record $110.0 million, reflecting broad-based growth across all FX products.

Equities revenues were flat at $62.9 million, as a result of higher European and U.S. equity volumes being offset by lower Asian equity derivative volumes.

Data, Network, and Post-trade revenues increased by 5.2% to $32.5 million. This growth was primarily driven by Fenics Market Data and Lucera, partially offset by lower post-trade revenues due to the sale of BGC’s Capitalab business in the fourth quarter of 2024. Excluding Capitalab, revenues grew by circa 10 percent year-over-year.

Interest and dividend income, Fees from related parties and Other revenues increased by 6.4 percent to $21.0 million, due to higher interest income versus the year ago period.

Pre-tax Adjusted Earnings amounted to $160.2 million, up 18.4% in annual terms.

Post-tax Adjusted Earnings reached $143.0 million, a 16.1% increase, resulting in post-tax Adjusted Earnings per share of $0.29, a 16% improvement.

Adjusted EBITDA amounted to $199.8 million, 4.1% lower compared to last year due to a $36.6 million mark-to-market gain in the prior period, related to a firm investment. Excluding this gain from the prior period, Adjusted EBITDA would have increased by 16.3%.

On May 6, 2025, BGC’s Board of Directors declared a quarterly qualified cash dividend of $0.02 per share payable on June 10, 2025 to Class A and Class B common stockholders of record as of May 27, 2025, which is the same date as the ex-dividend date.