BGC Group registers 21.3% Y/Y rise in FX revenues in Q4 2024

BGC Group, Inc. (NASDAQ:BGC) today reported its financial results for the fourth quarter and full year ended December 31, 2024.

Foreign Exchange revenues were up 21.3% to $93.6 million, primarily driven by higher options and emerging market foreign exchange volumes.

Rates revenues increased by 8.8% from the year-ago quarter to $169.6 million, reflecting higher volumes across interest rate derivatives, listed rates products, and U.S. Treasuries.

Data, Network, and Post-trade revenues increased by 10.3% to $32.6 million. This growth was primarily driven by strong subscription-based revenue growth across Fenics Market Data and Lucera, partially offset by lower post-trade revenues due to the sale of BGC’s Capitalab business in the fourth quarter.

Revenues for Data, Network, and Post-trade, excluding the impact of Capitalab, grew by more than 20 percent year-over-year.

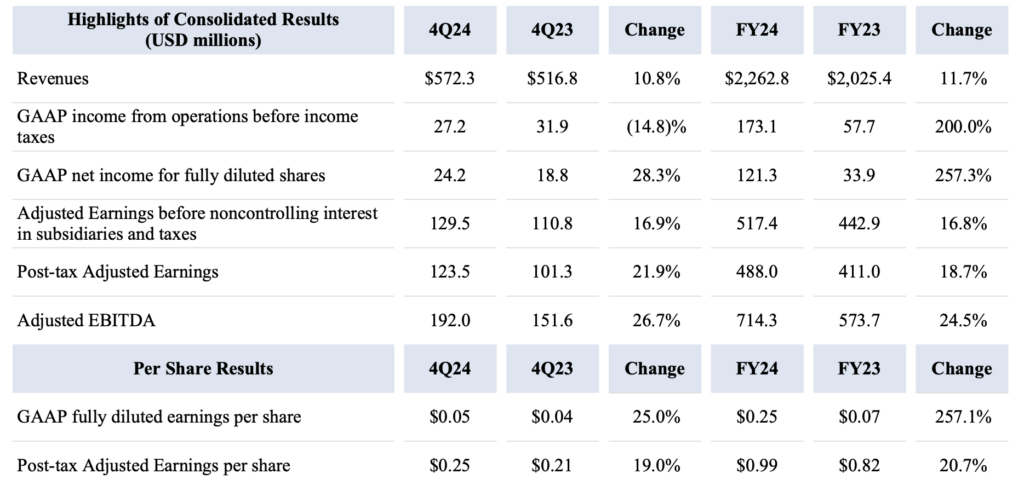

Pre-tax Adjusted Earnings amounted to $129.5 million, up 16.9%.

Post-tax Adjusted Earnings reached $123.5 million, a 21.9% increase, resulting in post-tax Adjusted

Earnings per share of $0.25, a 19% improvement.

Adjusted EBITDA amounted to $192.0 million, 26.7% higher compared to last year.

On February 13, 2025, BGC’s Board of Directors declared a quarterly qualified cash dividend of $0.02 per share payable on March 20, 2025 to Class A and Class B common stockholders of record as of March 6, 2025, which is the same date as the ex-dividend date.

Sean Windeatt, Chief Operating Officer, commented:

“BGC delivered record fourth quarter and full year revenues, growing by 11 and 12 percent, respectively. Our strong revenue growth was driven by our ECS, Rates, and Foreign Exchange businesses, which continue to outperform the market. This momentum has carried forward into 2025, with trading volumes currently outpacing last year’s first quarter records.

We would also like to congratulate our Chairman and CEO, Howard W. Lutnick, on his nomination as the 41st United States Secretary of Commerce. We are confident that, upon his confirmation, he will bring the same level of dedication and financial acumen to his new role serving the American people as he has at BGC.”