BGC Group posts 15.9% Y/Y increase in Forex revenues in Q3 2025

BGC Group, Inc. (NASDAQ:BGC) today reported its financial results for the quarter ended September 30, 2025.

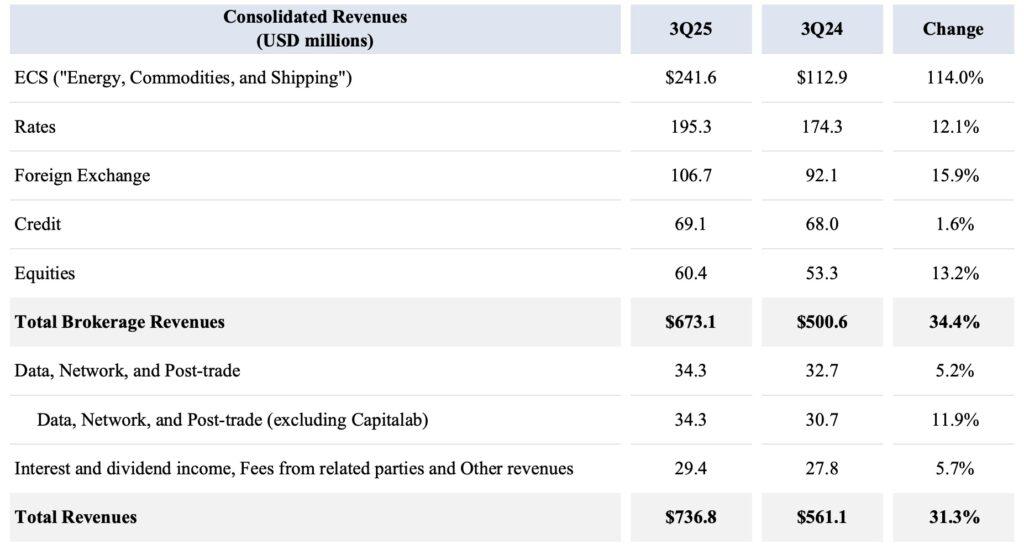

Foreign Exchange revenues were up 15.9% to $106.7 million, primarily due to strong growth in emerging market currencies and FX options volumes.

Equities revenues grew by 13.2% to $60.4 million, reflecting strong European and U.S. equity volumes and continued market share gains in these geographies.

Total brokerage revenues grew by 34.4% in the third quarter 2025.

Across all segments, total revenues amounted to $736.8 million, a 31.3% increase versus the equivalent period in 2024. Fenics revenues reached $160.0 million, an increase of 12.7%.

EMEA, Americas, and APAC saw revenue growth of 37.4 percent, 28.1 percent, and 17.4 percent, respectively.

BGC posted record third quarter Adjusted Earnings, including:

- Pre-tax Adjusted Earnings of $155.1 million, up 22.4%.

- Post-tax Adjusted Earnings of $141.1 million, an 11.5% increase, resulting in post-tax Adjusted Earnings per share of $0.29, an 11.5% improvement.

- Adjusted EBITDA of $167.6 million, 10.7% higher compared to last year.

John Abularrage, Co-Chief Executive Officer, commented:

“We delivered another outstanding quarter, with record third quarter revenues of $737 million, up 31 percent from $561 million a year ago. Revenues of $628 million, excluding OTC, was also a record, driven by growth across every asset class and geography. Our ability to deliver strong growth in a mixed macro environment demonstrates the strength and scale of our global platform.

FMX continues to outperform, setting new records in SOFR futures and U.S. Treasuries. SOFR futures saw both ADV and open interest increase more than 3-fold versus the previous quarter. This momentum has continued into October, where we set multiple new daily volume and open interest records. Our U.S. Treasury market share grew to an all-time high of 37 percent, significantly outpacing the market.

Our $25 million cost reduction program will be completed by year-end. This program will enhance our profitability and margins, as we continue to focus on delivering long-term shareholder value.”

On November 5, 2025, BGC’s Board and Audit Committee reapproved its Share Repurchase Authorization for up to $400 million. BGC anticipates reducing its full-year share count further in the fourth quarter of 2025, in addition to repaying its $300 million Senior Notes due December 15, 2025.

On November 5, 2025, BGC’s Board of Directors declared a quarterly qualified cash dividend of $0.02 per share payable on December 10, 2025 to Class A and Class B common stockholders of record as of November 26, 2025, which is the same date as the ex-dividend date.