Bank of America registers rise in Global Markets income in Q2 2022

Bank of America Corp (NYSE:BAC) today posted its financial report for the three-month period to end-June 2022.

Bank of America reported net income from its Global Markets segment of $1.0 billion, up $110 million from the year-ago period. The result, however, lagged behind the net income of $1.5 billion registered in the first quarter of 2022.

In the second quarter of 2022, the Global Markets segment saw revenue of $4.5 billion, down 5% from the year-ago period, primarily due to lower investment banking fees and mark-to-market losses related to leveraged finance positions, partially offset by higher sales and trading revenue

Sales and trading revenue increased 17% to $4.2 billion. FICC revenue increased to $2.5 billion, driven by improved performance across all macro products, partially offset by a weaker trading performance in credit products.

Equities revenue increased to $1.7 billion, driven by a strong trading performance in derivatives offset by a weaker trading performance in cash.

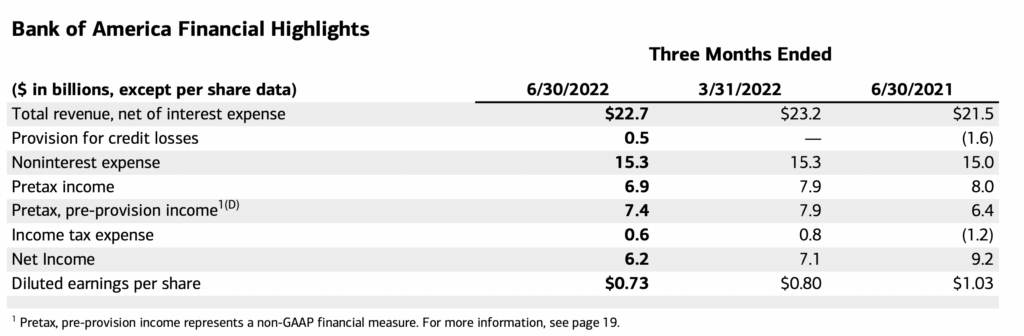

Across all segments, net income amounted to $6.2billion, or $0.73 per diluted share. Pre-tax income declined 14% to $6.9 billion reflecting a smaller reserve release than Q2-21

Revenue, net of interest expense, increased 6% in annual terms to $22.7 billion.

Chair and CEO Brian Moynihan commented:

“Our strong organic growth engine once again was evident in new account openings for checking, consumer investments, and small businesses, as well as net new Merrill and Private Bank households and new commercial banking customers. This solid client activity across our businesses, coupled with higher interest rates, drove strong net interest income growth and allowed us to perform well in a weakened capital markets environment. We grew revenue 6% and delivered our fourth straight quarter of operating leverage.

Our U.S. consumer clients remained resilient with continued strong deposit balances and spending levels. Loan growth continued across our franchise and our markets teams helped clients navigate significant volatility reflecting economic uncertainty. As we enter the second half of the year, we believe we are well-positioned to deliver for our shareholders while continuing to invest in our people, businesses and communities.”