AEGIS Hedging acquires pioneer in metals hedging Nexidus Commodities

AEGIS Hedging Solutions today announced the acquisition of Nexidus Commodities, a commodity trading advisor and pioneer in metals hedging.

Established in 2017, Nexidus provides research, strategy, execution, and administrative support to companies in the industrials and manufacturing sectors hedging their exposures to base and precious metals. Nexidus has capitalized on significant, growing demand from financial sponsors seeking visibility into and management of metals exposures across their portfolio companies, as commodity pricing and rate exposures have a significant impact on cash flow and related valuations.

AEGIS’ acquisition of Nexidus was made in partnership with private equity firm Trilantic North America, which recently invested in AEGIS to support the execution of its growth strategy and accelerate its expansion across the metals, refined products, interest rates, and Forex sectors.

AEGIS’s co-founders, Bryan Sansbury, Chris Croom, and Justin McCrann, who serve as CEO, President, and Chief Operating Officer, respectively, continue to lead the business and have retained significant equity stakes in the company.

Chris Manning, Managing Partner at Trilantic North America and Chairman of Trilantic Energy Partners North America, comments:

“The acquisition of Nexidus represents an exciting first step in the Company’s next phase of growth as we look to aggressively expand AEGIS’ presence in new end markets.”

Chris Croom, President of AEGIS, adds:

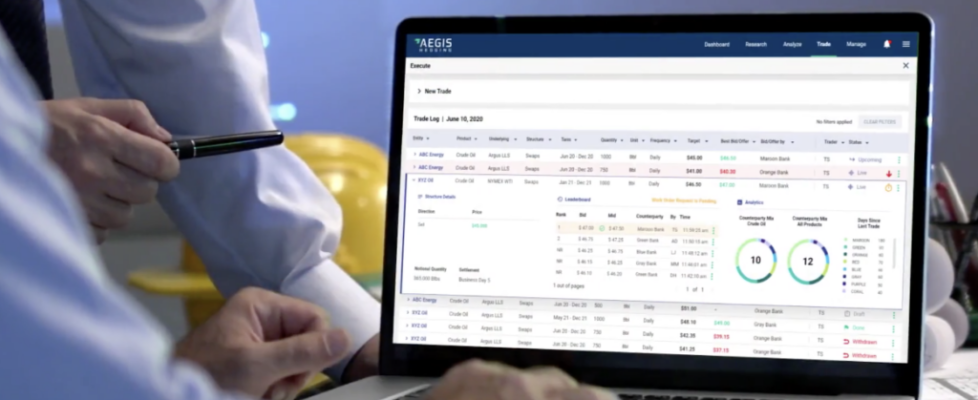

“Trilantic North America has a strong record of partnering with founder-led businesses to build leading-edge companies within the North American energy, services, and consumer sectors. The team quickly understood our growth objectives and their investment will help us leverage our existing technology platform to accelerate AEGIS’ expansion.”

Baird Capital, which first invested in AEGIS in 2019, will retain a material ownership stake.