ForexCT’s Steven Marsh banned for high pressure sales

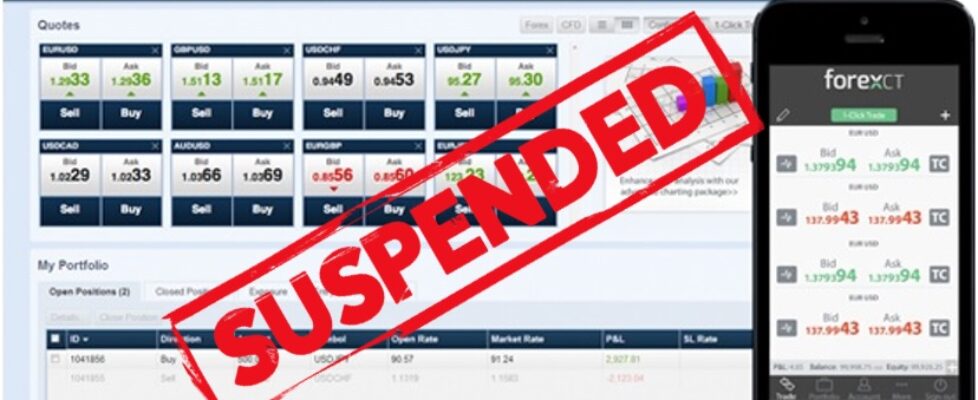

Australia financial regulator ASIC has taken further action against retail forex broker Forex Capital Trading Pty Ltd, which operates the brand ForexCT (at website forexct.com.au).

Earlier this month FNG reported that ASIC had suspended the AFS license of ForexCT, citing a number of reasons including the disregarding of key obligations, unconscionable conduct, misleading and deceptive conduct, a failure to manage conflicts of interest, lacking sound ethical values in dealing with clients, and a failure to ensure its representatives were adequately trained.

Now the regulator is beginning its move against ForexCT employees, and has banned Steven Marsh, a former account manager at ForexCT. Mr. Marsh is banned from providing financial services for a period of three years.

We expect that this will not be the last such sanction of a ForexCT employee or manager by ASIC, with more action likely pending.

Steven Marsh was an account manager at ForexCT between 19 February 2018 and 20 March 2019. During this period, Mr. Marsh engaged with clients to trade in contracts-for-difference (CFDs) and margin foreign exchange contracts (FX Contracts).

In making the banning order, ASIC found Mr Marsh:

- has not complied with financial services law;

- is not adequately trained or is not competent to provide financial services; and

- is not a fit and proper person to provide financial services.

ASIC found Mr Marsh made misleading representations to clients, including that:

- clients would make profits trading with Forex CT when there were no reasonable grounds for making such representations, given that an investment in a CFD is a speculative high-risk investment; and

- clients reduced the risk of incurring trading losses if they made increased deposits into their trading accounts, when in fact increased deposits would have the effect of placing more client money at risk.

ASIC also found Mr. Marsh engaged in unconscionable conduct. This included engaging in high pressure sales strategies and unfair practices in order to encourage clients to make deposits or delay or cancel client requests to withdraw their own funds from their trading accounts.

In finding that Mr. Marsh is not adequately trained or competent, ASIC found Mr Marsh failed to provide the general advice warning when giving general financial advice and, on several occasions, provided personal advice.

The regulator stated that Steven Marsh has the right to appeal to the Administrative Appeals Tribunal for a review of ASIC’s decision.

ASIC noted that the size of the Australian market for OTC retail derivatives has grown considerably over recent years. With that growth, there has been a dramatic increase in complaints to ASIC in relation to conduct within the OTC retail derivatives market. ASIC stated that it has and will continue to take strong regulatory action to protect consumers of these products.