Nasdaq reports 6% Y/Y rise in revenues for Q3 2022

Nasdaq, Inc. (NASDAQ:NDAQ) today reported financial results for the third quarter of 2022, with revenues staging a rise from the year-ago period.

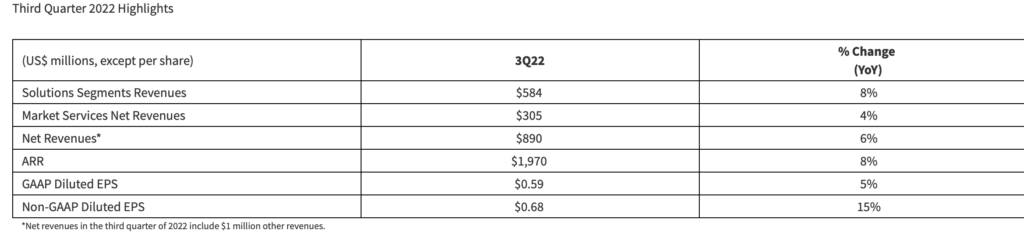

Third quarter 2022 net revenues were $890 million, an increase of $52 million, or 6%, from $838 million in the prior year period. Net revenues reflected a $77 million, or 9%, positive impact from organic growth, including positive contributions from all segments, partially offset by a $22 million decrease from the impact of changes in FX rates and a $3 million decrease from the net impact of an acquisition and divestitures.

Solutions segments revenues were $584 million in the third quarter of 2022, an increase of $43 million, or 8%. The increase reflects a $53 million, or 10%, positive impact from organic growth, and a $1 million increase from acquisitions, partially offset by a $11 million decrease from the impact of changes in FX rates.

Market Services net revenues were $305 million in the third quarter of 2022, an increase of $13 million, or 4%. The increase reflects a $24 million, or 8%, positive impact from organic growth, partially offset by a $11 million decrease from the impact of changes in FX rates.

Third quarter 2022 GAAP operating expenses increased $10 million, or 2%, versus the prior year period. The increase primarily reflects higher compensation and benefits expense due to continued investment in our people, higher computer operations and data communications expense, partially offset by lower general, administrative and other expense due to lower capital markets activity and lower depreciation and amortization expense.

The company repurchased $633 million in shares of its common stock during the first nine months of 2022. As of September 30, 2022, there was $293 million remaining under the board authorized share repurchase program.

Nasdaq has recently announced new corporate structure to amplify strategy. On September 28, 2022, Nasdaq announced that it is organizing its business units into three divisions: Market Platforms, Capital Access Platforms, and Anti-Financial Crime. This new structure will align the company more closely to the foundational shifts that are driving the evolution of the global financial system and evolving client needs.

The new structure will take effect by the end of the fourth quarter of 2022 with the corresponding executive appointments taking effect on January 1, 2023.