Nasdaq registers 12% Y/Y growth in revenues in Q4 2021

Nasdaq, Inc. (NASDAQ:NDAQ) today reported financial results for the fourth quarter of 2021 and full year 2021.

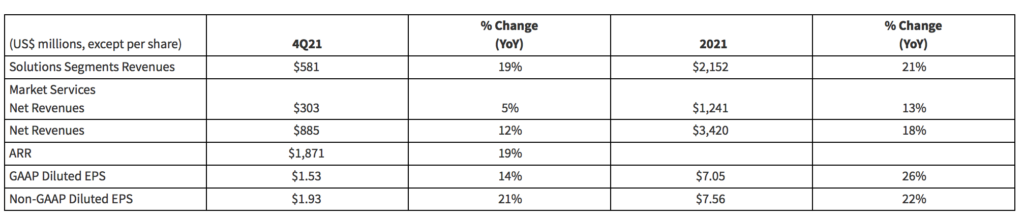

2021 net revenues were $3,420 million, an increase of $517 million, or 18% over 2020. Net revenues reflected a $395 million, or 14%, positive impact from organic growth, a $93 million increase from the net impact of acquisitions and divestitures, and a $29 million increase from the impact of changes in FX rates.

Fourth quarter 2021 net revenues were $885 million, an increase of $97 million, or 12%, from $788 million in the prior year period. Net revenues reflected a $78 million, or 10%, positive impact from organic growth and a $26 million increase from the net impact of acquisitions and divestitures, partially offset by a $7 million decrease from the impact of changes in FX rates.

Solutions segments revenues were $581 million in the fourth quarter of 2021, an increase of $91 million, or 19%. The increase reflects a $61 million, or 12%, positive impact from organic growth and a $35 million, or 7%, increase from the inclusion of revenues from the acquisition of Verafin, partially offset by a $5 million decrease from the impact of changes in FX rates.

Market Services net revenues were $303 million in the fourth quarter of 2021, an increase of $15 million, or 5%. The increase reflects a $17 million, or 6%, positive impact from organic growth, partially offset by a $2 million decrease from the impact of changes in FX rates.

Fourth quarter 2021 GAAP operating expenses increased 15% versus the prior year period. The increase primarily reflects higher compensation and benefits expense, regulatory expense, depreciation and amortization expense, partially offset by lower general, administrative and other expense and restructuring charges.

The company repurchased $58 million in shares of its common stock fourth quarter of 2021 and repurchased an aggregate of $943 million in 2021, including the impact of the $475 million accelerated share repurchase (ASR) agreement executed in the second half of 2021.

The company repurchased $142 million in shares in January 2022, and plans to enter into an ASR agreement to repurchase an additional $325 million of shares, which is expected to be completed in the first quarter of 2022. As of January 25, 2022, there was $784 million remaining under the board authorized share repurchase program.

Adena Friedman, President and CEO said,

“Our record performance in 2021 is another important milestone in Nasdaq’s journey as a technology business serving the financial system. We grew across all segments of our business last year with a focus on competitive positioning, innovation in our trading and listing businesses, and the continued expansion of our software, analytics, data and cloud services.

We have entered 2022 in a position of strength across all of our businesses, primed to capture secular growth opportunities as we continue to play our part in increasing investor participation, optimizing capital formation, and driving efficiency and resiliency in the global financial system.”