ICE books Q4 2025 revenues of $2.5bn, up 8% Y/Y

Intercontinental Exchange (NYSE:ICE), a global provider of technology and data, today reported financial results for the fourth quarter and full year of 2025.

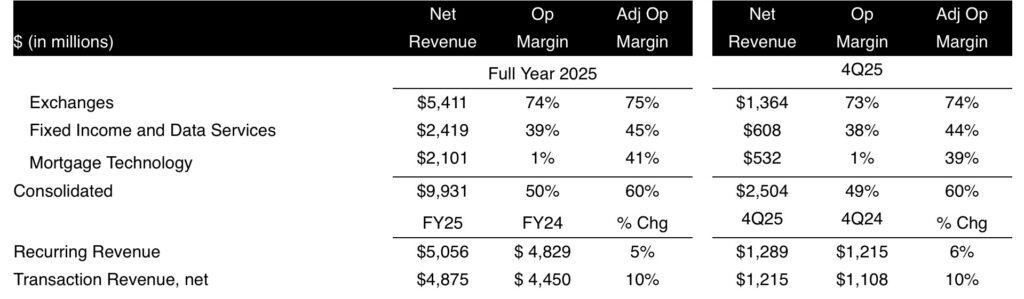

Fourth quarter consolidated net revenues were $2.5 billion, up 8% year-over-year, including exchange net revenues of $1.4 billion, fixed income and data services revenues of $608 million and mortgage technology revenues of $532 million.

Consolidated operating expenses were $1.3 billion for the fourth quarter of 2025. On an adjusted basis, consolidated operating expenses were $1.0 billion. Consolidated operating income for the fourth quarter was $1.2 billion and the operating margin was 49%.

On an adjusted basis, consolidated operating income for the fourth quarter was $1.5 billion and the adjusted operating margin was 60%.

Full year 2025 consolidated net revenues were $9.9 billion, up 7% year-over-year, including exchange net revenues of $5.4 billion, fixed income and data services revenues of $2.4 billion and mortgage technology revenues of $2.1 billion. Consolidated operating expenses were $5.0 billion for 2025. On an adjusted basis, consolidated operating expenses were $3.9 billion. Consolidated operating income for the year was $4.9 billion and the operating margin was 50%. On an adjusted basis, consolidated operating income for the year was $6.0 billion and the adjusted operating margin was 60%.

Warren Gardiner, ICE Chief Financial Officer, commented:

“Our fourth quarter results capped another year of record revenues and operating income, supported by strong, durable cash flows from each of our major business lines and continued attention to operating efficiency. We maintained a balanced approach to leverage, ending the year well within our target leverage range, enabling us to reinvest in our network, while also returning $2.4 billion to shareholders. As we look ahead to 2026, we remain focused on disciplined investment, operational rigor, and enhancing the value we deliver to our customers and shareholders.”