Deutsche Börse registers 24% Y/Y increase in revenues in 2022

Deutsche Börse has reported its financial results for the full year of 2022.

The financial year 2022 was strongly affected more by cyclical factors. Higher average volatility compared with the previous year resulted in significantly higher trading volumes in the Trading & Clearing segment, particularly in the asset classes financial derivatives and commodities. Index derivatives and gas products saw an exceptionally strong increase in volumes.

The US dollar’s rise against the euro also stimulated Forex trading. Margin fees from cash collateral deposits also went up significantly, as the requirements in the clearing business were higher due to increased volatility. Increases in base rates by central banks to curb high inflation rates had primarily a positive impact on net interest income from banking business in the Securities Services segment.

Interest rate hikes also increased market participants’ need for hedging instruments and resulted in higher trading volumes for interest rate derivatives in the Trading & Clearing segment.

In addition, higher demand in the Data & Analytics segment for products related to Governance Solutions, Corporate Solutions and ESG supported the secular growth.

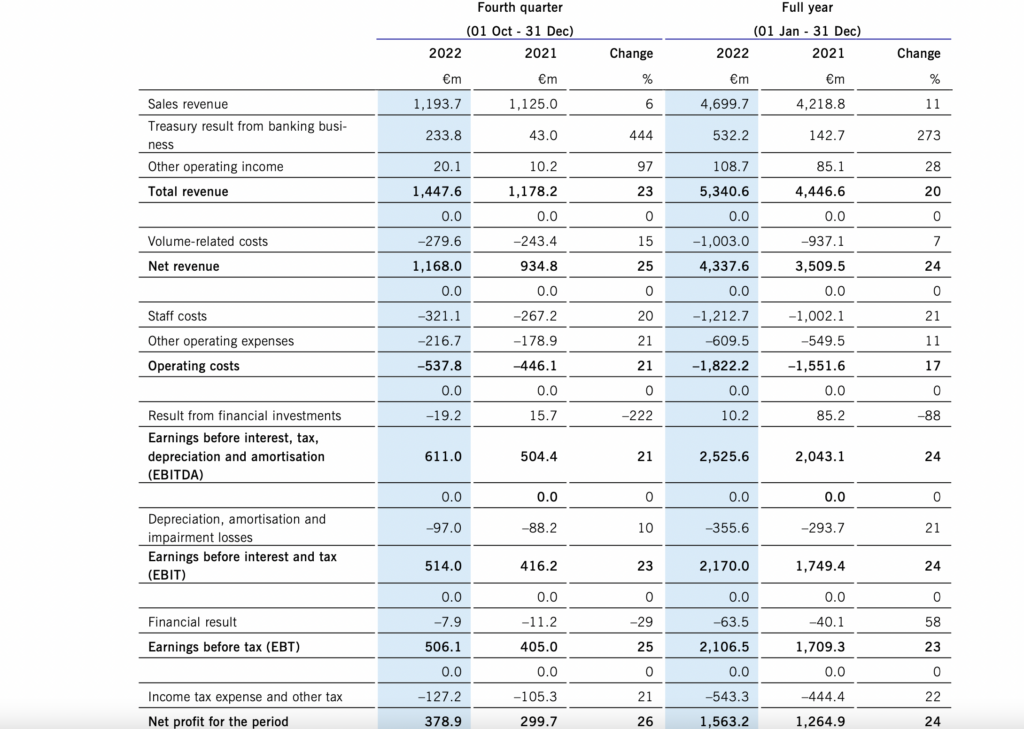

Deutsche Börse’s net revenue increased to €4,337.6 million in the 2022 financial year (2021: €3,509.5 million). Net revenue growth of 24 per cent was made up of secular net revenue growth of 7 per cent, cyclical growth of 14 per cent and M&A effects of 3 per cent.

Operating costs went up 17 per cent year on year in 2022, to €–1,822.2 million (2021: €–1,551.6 million). Of the total, 4 per cent is due to M&A-related growth and 3 per cent to exchange rate effects resulting from the US dollar’s rise against the euro. The remaining organic cost increase of 10 per cent breaks down into higher costs amongst others due to inflation, as well as variable and share-based payments.

Earnings before interest, tax, depreciation and amortisation (EBITDA) amounted to €2,525.6 million (2021: €2,043.1 million), an increase of 24 per cent. This includes the result from financial invest- ments of €10.2 million (2021: €85.2 million). The significant decline is due mainly to higher valuation effects in the previous year (€45 million) and weaker performance by various minority investments in 2022.

Overall, the net profit for the period attributable to Deutsche Börse Group shareholders was €1,494.4 million (2021: €1,209.7 million). This represents a year-on-year increase of 24 per cent. Undiluted earnings per share were €8.14 (2021: €6.59) and earnings per share before the effects of pur- chase price allocation (cash EPS) were €8.61 (2021: €6.98).

The Executive Board of Deutsche Börse AG is proposing a dividend of €3.60 for financial year 2022 (2021: €3.20). This represents an increase of 13 per cent and a pay-out ratio of 44 per cent. The dividend still requires the formal approval of the Supervisory Board and shareholders of Deutsche Börse AG at the Annual General Meeting on 16 May 2023; the Supervisory Board has already expressed its support for the proposal.

With the strong result in the 2022 financial year the Group has achieved its mid-term targets under the growth strategy Compass 2023 already one year earlier than planned. Compared to the basis year 2019, net revenue grew by 14 per cent per annum on average and thus exceeded the initial strategic target of 10 per cent per annum on average. Secular net revenue growth came to 6 per cent per annum on average, M&A effects to 4 per cent and cyclical growth to 4 per cent.

For 2023 the Group is expecting net revenue to increase to €4.5–4.7 billion and the EBITDA to €2.6–2.8 billion. The net revenue growth guidance is based largely on expected continued secular growth. The impact of cyclical effects within the range will depend on the further development of interest rates as well as market volatility.

Theodor Weimer, CEO of Deutsche Börse AG, stated:

„During the past year we have not only clearly exceeded our guidance, but also reached the targets of our growth strategy Compass 2023 one year earlier. We fully exploited the power of our diversified business model. We achieved further strong secular growth. And our clients’ increased hedging needs as well as rising interest rates resulted in significant cyclical tailwinds.”

Regarding the outlook Mr. Weimer said:

“Despite the expected economic slowdown we are anticipating our business to continue to grow further in the current year. Secular growth will remain key pillar of our strategy, complemented by M&A where strategically and financially sensible. In addition, we are expecting further cyclical momentum in the new era of monetary policy.”