Cboe reports rise in global FX revenues in Q4 2020

Exchange operator Cboe Global Markets, Inc. has posted a set of solid financial results for the 2020 fourth quarter and full year.

Global FX net revenue amounted to $14.0 million in the final quarter of 2020, up 9% from a year earlier, primarily as a result of higher net transaction and clearing fees and access and capacity fees. The result for the fourth quarter of 2020 is also higher than the one registered in the third quarter of 2020.

ADNV traded on the Cboe FX platform was $33.7 billion for the quarter, up 12% from last year’s fourth quarter and net capture per one million dollars traded was $2.64 for fourth-quarter 2020, down 6% compared to $2.80 in the fourth quarter of 2019.

Cboe FX had record market share of 16.7% for the quarter compared to 16.0% in last year’s fourth quarter.

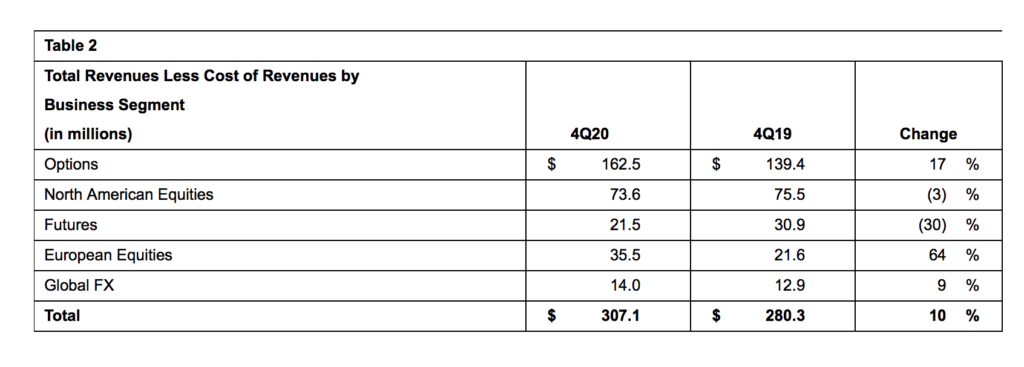

Across all business segments, total revenues less cost of revenues reached $307.1 million in the final quarter of 2020, up 10% from the result registered in the prior-year period, primarily reflecting increases in net transaction and clearing fees, access and capacity fees and market data fees. In addition to acquisitions completed in the first half of the year, fourth quarter results include the acquisitions of EuroCCP, which closed on July 1, 2020, and MATCHNow, which closed on August 4, 2020.

Operating income increased by 13% to $134.8 million and adjusted operating income increased by 6% to $194.9 million.

Diluted EPS for the fourth quarter of 2020 increased 5% to $0.81. Adjusted diluted EPS of $1.21 was flat compared to 2019’s fourth-quarter results.

The company also provided guidance for the 2021 fiscal year. This guidance takes into account the company’s acquisitions completed through December 31, 2020, including BIDS Trading; its investment in launching European derivatives trading and clearing; investments to support the company’s growth initiatives; and one-time and non-recurring savings recognized in 2020.

Cboe expects recently closed acquisitions to contribute net revenue growth in a range of 4 to 6 percentage points.

Recurring non-transactional revenue, defined as access and capacity fees plus proprietary market data, is targeted to increase by 7 percent to 8 percent, from a base of $342 million in 2020, with organic growth targeted in a range of 6 to 7 percent.

Edward T. Tilly, Cboe Global Markets Chairman, President and Chief Executive Officer, commented:

“We plan to continue to advance our strategy while leveraging our recent acquisitions to accelerate further growth. We are targeting mid-term organic net revenue growth of 4 to 6 percentage points and believe we can drive additional organic growth longer-term through our ongoing investment in attractive market opportunities. I am excited to build on the progress made by our team in 2020 to capitalize on our strategic opportunities in 2021 and beyond and deliver increased value to our customers and shareholders.”