Cboe reports 6% Y/Y increase in Global FX revenue for Q4 2021

Cboe Global Markets, Inc today reported financial results for the 2021 fourth quarter and full year.

Global FX net revenue for the final quarter of 2021 amounted to $14.8 million, marking a growth of 6%, driven by higher net transaction and clearing fees. ADNV traded on the Cboe FX platform was $33.7 billion for the quarter, which was relatively flat compared to last year’s fourth quarter and net capture per one million dollars traded was $2.77 for the quarter, up 4 percent compared to $2.67 in the fourth quarter of 2020.

Cboe SEF recorded its sixth consecutive record ADV quarter at 725 million contracts vs. 135 million in fourth quarter 2020.

Cboe FX market share was 16.8 percent for the quarter compared to 16.7 percent in last year’s fourth quarter.

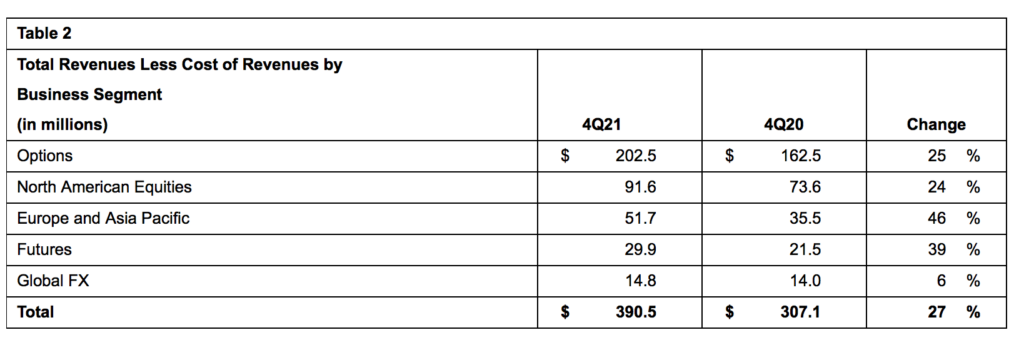

Across all business segments, total revenues less cost of revenues (referred to as “net revenue”) of $390.5 million increased 27 percent, compared to $307.1 million in the prior-year period, reflecting increases in net transaction and clearing fees and access and capacity fees. Inorganic net revenue1 in the fourth quarter of 2021 was $17.0 million.

Total operating expenses were $169.9 million versus $172.3 million in the fourth quarter of 2020. Adjusted operating expenses¹ of $137.5 million increased 23 percent compared with $112.2 million in the fourth quarter of 2020, primarily due to the acquisitions of BIDS Trading and Chi-X Asia Pacific, which closed in late 2020 and middle of 2021, respectively, resulting in higher compensation and benefits.

Diluted EPS for the fourth quarter of 2021 increased 91 percent to $1.54. Adjusted diluted EPS of $1.70 increased 41 percent compared to 2020’s fourth quarter results.

For 2022, Cboe expects to deliver 5 to 7 percentage points of organic total net revenue growth and 7 to 10 percentage points of organic net revenue growth in Data and Access Solutions.