Cboe registers 9% Y/Y increase in global FX revenues in Q3 2024

Cboe Global Markets, Inc. today reported financial results for the third quarter of 2024.

Global FX record net revenue of $20.0 million increased 9% from the year-ago period, primarily due to higher net transaction and clearing fees.

ADNV traded on the Cboe FX platform was $48.3 billion for the quarter, up 9% compared to last year’s third quarter, and net capture rate per one million dollars traded was $2.66 for the quarter, up 1% compared to $2.64 in the third quarter of 2023.

Cboe FX market share was 19.1% for the quarter compared to 20.2 percent in last year’s third quarter.

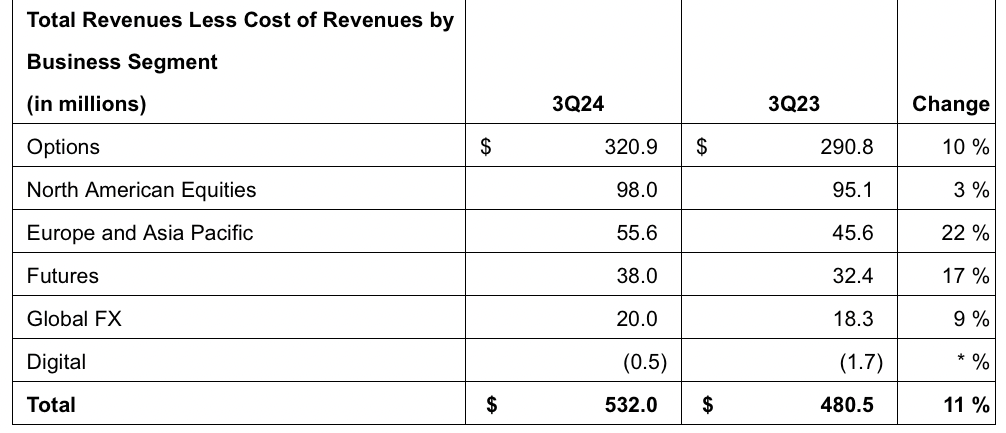

Total revenues less cost of revenues (net revenue) of $532.0 million increased 11%, compared to $480.5 million in the prior-year period, a result of increases in derivatives markets, cash and spot markets, and data and access solutions net revenue.

Diluted EPS for the third quarter of 2024 increased 6 percent to $2.07 compared to the third quarter of 2023. Adjusted diluted EPS of $2.22 increased 8 percent compared to 2023 third quarter results.

At September 30, 2024, the company had cash and cash equivalents of $763.2 million and adjusted cash2 of $763.7 million. Total debt as of September 30, 2024 was $1,440.6 million.

The company paid cash dividends of $66.3 million, or $0.63 per share, during the third quarter of 2024 and utilized $24.6 million to repurchase approximately 144 thousand shares of its common stock under its share repurchase program at an average price of $170.45 per share.

As of September 30, 2024, the company had approximately $679.8 million of availability remaining under its existing share repurchase authorizations.