SEC seeks $22.6M in penalties, disgorgement from Meta 1 Coin

The Securities and Exchange Commission (SEC) has outlined the proposed penalties sought in the lawsuit against Meta 1 Coin Trust (Meta1) and several individuals linked to it. The relevant documents were submitted at the Texas Western District Court on September 22, 2022.

The SEC seeks final judgments as to: (1) Defendants Meta 1 Coin Trust (“Meta1”), Robert P. Dunlap, individually and d/b/a Clear International Trust, and Nicole Bowdler; (2) David A. Schmidt; and (3) Relief Defendants Wanda Ironheart Traversie-Warner, Alfred Warner, Ironheart Trust.

From April 2018 through the present, the defendants have raised over $15.2 million from at least 800 investors in 40 states and eight foreign countries, through deceptive acts and materially false and misleading statements and omissions.

For example, Defendants have falsely stated that: (a) investors were, in fact, purchasing asset-backed digital coins; (b) Meta1 owned $1 billion in art insured against loss by a surety bond, and later, that Meta1 owned $2 billion [and now $8.8 billion] in gold assets; (c) KPMG was auditing Meta1’s gold assets; (d) Meta1 formed its own investment bank and developed its own digital currency exchange; (e) the Coin is safe and risk-free and will never lose value; (f) an initial public offering of the Coin (ICO) on its own exchange was imminent; and (g) each Coin, sold for either $22.22 or $44.44 would in two years be worth $50,000—up to a 224,923% return—as a “very conservative value.”

Defendants enticed investors with the allure of a cryptocurrency, but the securities offering is nothing but a vehicle to steal investors’ money. In reality, as Defendants knew each of the statements listed above was, and is, false.

And although Defendants assured investors that KPMG verified and affirmed Meta1’s gold valuations to bolster their claims that the Coin was safe and risk-free, those assurances were lies. KPMG never performed any audit services for Meta1, or anyone associated with Meta1 or any of the Defendants.

Despite many court orders and even an arrest warrant, Dunlap and Meta1 continue to operate and market the investment scheme through various means, including its website, social media, Zoom calls with investors and prospective investors, in-person seminars, and on an internet radio show.

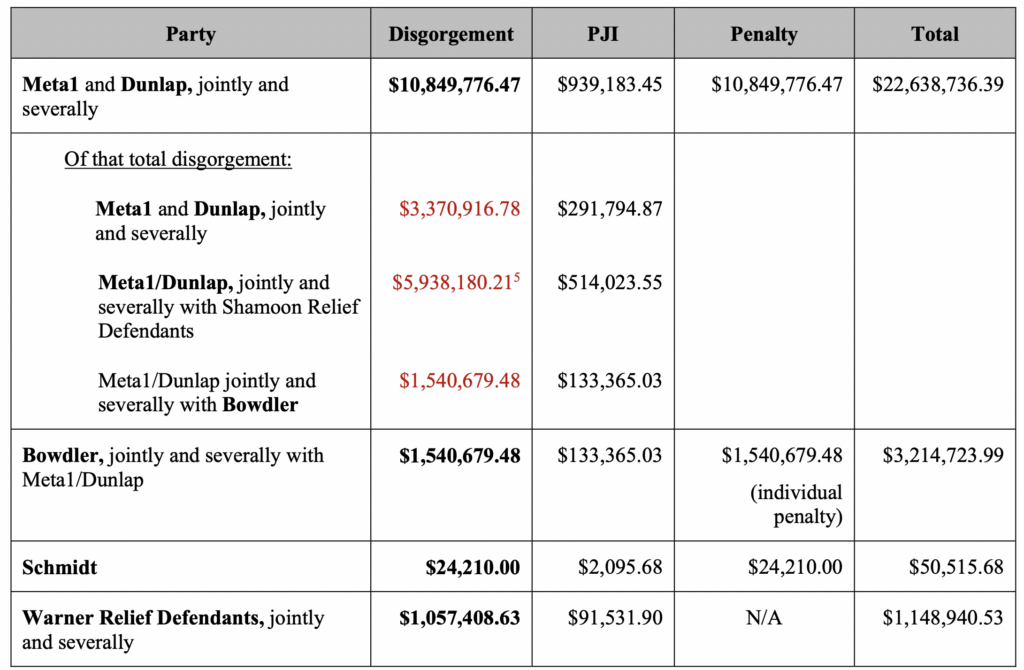

The details of the penalties sought by the SEC are summarized in the table below:

September 30, 2022 @ 11:53 pm

Hi Maria, I tried messaging you on Linkedn but for some reason am unable to do so. I was hoping to find out your latest perspective on Meta1. It appears this article is your most recent update, correct?

October 1, 2022 @ 6:10 pm

Yes.

April 4, 2023 @ 4:03 am

Will these people actually be shut down, or just fined, which we know they won’t pay?

July 17, 2023 @ 10:09 pm

I bought a total 13 coins starting Dec 2016 when Robert P. Dunlap, and David A. Schmidt and more was in Dallas Tx for their META1 conference. How do I join this lawsuit, I have not been able pull up access to my account with META 1 coins for a few years and my email with them just go around and around to nowhere.

July 18, 2023 @ 7:33 am

Billie, you do not join an action brought by the SEC. Instead, you can contact the SEC with your questions. Before that, consult the information provided by the regulator to harmed investors: https://www.sec.gov/enforce/information-for-harmed-investors