CrossTower April crypto volumes top $300M, adds $25M AUM

CrossTower, a Jersey City, NJ based cryptocurrency trading platform startup aimed at institutional traders has announced that it saw record crypto trading volumes of $319 million in April – less than a year since the official launch of its US trading platform. The company said it posted a 200% increase in trading volumes over the prior month, as incumbents ceded market share to CrossTower.

“As the crypto industry continues to mature globally, discerning participants are gravitating to our platform because of our expanded world-class capabilities, including innovative financing solutions that have attracted more than $25 million in new assets under management,” said Kapil Rathi, Co-Founder and CEO of CrossTower.

In March, CrossTower reported $158 million February trading volumes, nearly tripling the volumes traded on its platform since October 2020. CrossTower said it credits its growing dominance to the caliber of its platform, products and services. The firm recently launched a new capital markets desk, an intuitive wallet app, structured products and a Bitcoin fund that offers accredited investors a seamless onramp to Bitcoin.

CrossTower’s growth has been further fueled by the addition of a new financing business with $25 million in AUM, including credit card payment, borrowing and lending.

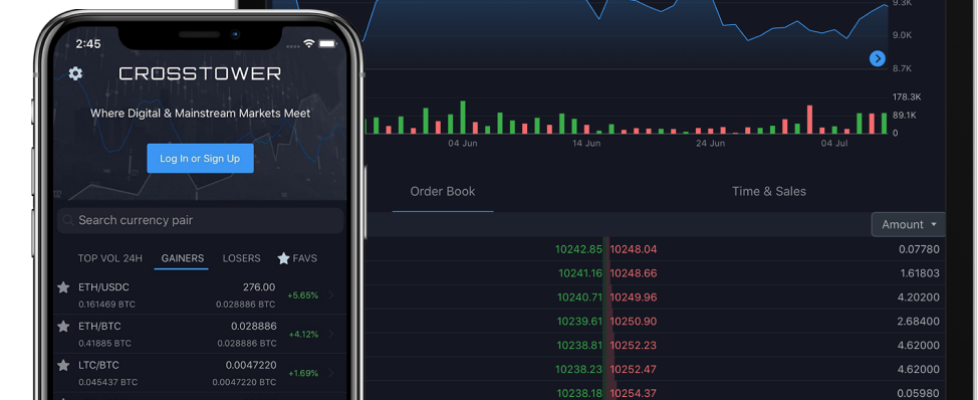

CrossTower launched its trading platform in 2020, and in 2021 introduced a crypto capital markets desk with best-in-class services and products tailored to the needs of demanding traders and institutions, including hedge funds, family offices and other market participants. The company has leveraged its management’s vast experience in trading, technology, operational infrastructure, innovative pricing, regulations and compliance to make crypto and digital assets accessible to discerning retail and sophisticated institutional market participants.