Belgian regulator proposes classification of crypto-assets

Belgium’s Financial Services and Markets Authority (FSMA) today outlined a proposal for the classification of crypto-assets as securities, investment instruments or financial instruments.

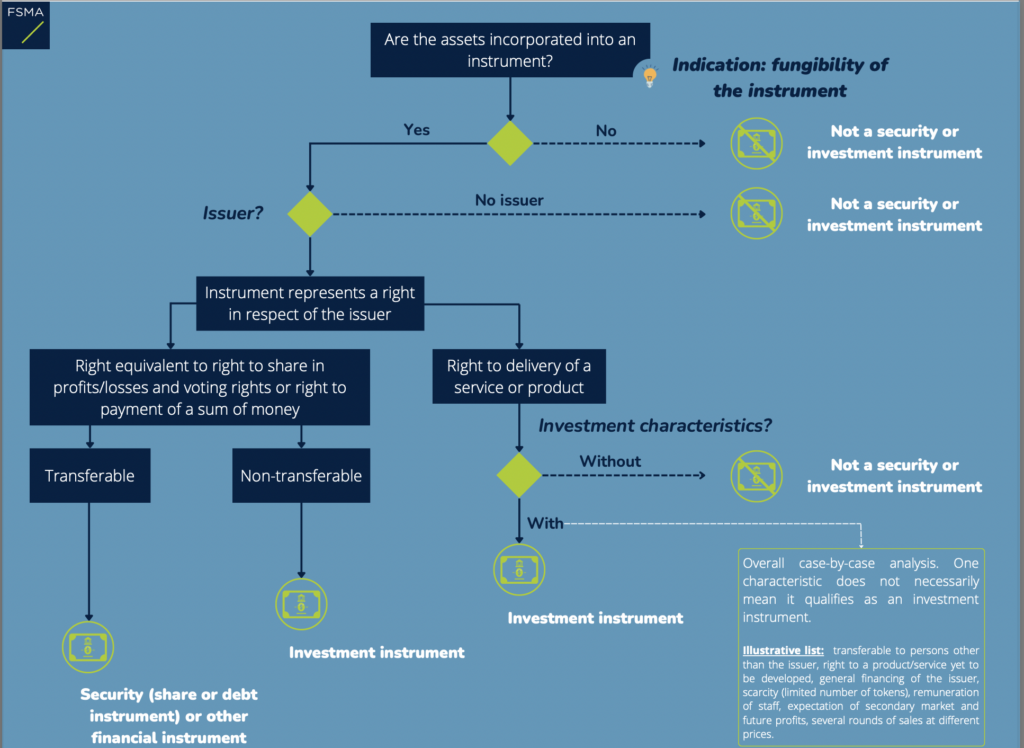

If the assets are incorporated into an instrument, then it is possible to distinguish between a situation in which an instrument represents a right in respect of an issuer and/or another person (such as a guarantor) and a situation where this is not the case. If there is no issuer, as in cases where instruments are created by a computer code that does not give rise to a legal relationship between two persons (e.g. Bitcoin or Ether), then in principle the Prospectus Regulation, the Prospectus Law and the MiFID rules of conduct do not apply.

Nevertheless, if the instruments have a payment or exchange function, other regulations may apply to the instruments or the persons who provide certain services relating to those instruments.

In the case of financial products with such instruments as their underlyings, one must first carry out the exercise of determining the classification of the financial product. Moreover, the FSMA Regulation of 3 April 2014 on the ban on the marketing of certain financial products to retail clients can also apply.

If there is an issuer of assets incorporated into instruments, then one of the following situations often presents itself:

- the instruments represent a right to a share in the profits or losses of a project and potentially a voting right, or a right to payment of a sum of money, or they are the equivalent thereto:

- if the instruments are transferable, then these are, as a rule, securities within the meaning of the Prospectus Regulation, and the obligation to publish a prospectus or an information note may apply based on that Regulation or the Prospectus Law if the conditions for application are met; they are in that case also financial instruments and the MiFID rules of conduct apply to them;

- if they are not transferable, then the instruments are classified in principle as investment instruments within the meaning of the Prospectus Law and there may thus be an obligation to draw up an information note or a prospectus.

- the instruments represent a right to the delivery of a service or a product by the issuer:

- if an overall analysis of the specific characteristics of the product and the way in which the instruments are brought to market indicates that the instruments have an investment objective, even if secondary, then the instruments are classified, as a rule, as investment instruments within the meaning of the Prospectus Law and there may thus be an obligation to draw up an information note or a prospectus;

- if the overall analysis indicates that there is no investment objective, then these instruments do not fall within the scope of the Prospectus Law.

In order to determine whether the instruments have an investment objective, the following aspects, among others, are important: the instruments are transferable to persons other than the issuer; the issuer issues a limited number of instruments; the issuer plans to trade them on a market and has an expectation of profit; the funds gathered are used for the general financing of the issuer and the service or the project have yet to be developed: the instruments are used to pay staff; the issuer organizes several rounds of sales at different prices.

This analysis is to be carried out on a case-by-case basis.

The FSMA is holding an open consultation on the Communication. It will run from 05/07/2022 to 31/07/2022. The consultation is addressed to all financial industry participants and to investors’ representatives.