Kraken parent Payward acquires token management platform Magna

Magna will continue operating as a standalone platform, powered by Kraken.

Magna will continue operating as a standalone platform, powered by Kraken.

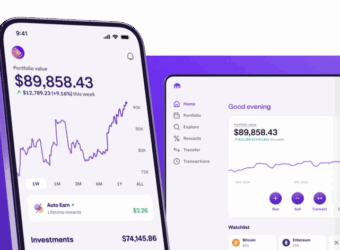

Revenue at Kraken was well balanced, with 47% from trading-based revenue and 53% from asset-based and other revenue.

Kraken and Deutsche Börse Group today announced a partnership to create unified access across traditional and digital asset markets.

Until now, xStocks were tradable on Kraken Pro 24 hours a day, five days a week.

The acquisition by Kraken gives Backed access to the capital and resources needed to scale faster and capitalize on surging adoption.

Participants who contribute significantly to market liquidity and trading activity can earn Kraken-equity-linked incentives.

Stavros Vassiliades joins Kraken after serving as Executive Director for Executive Director for Pepperstone EU Limited.

As part of a phased global rollout, Kraken will first offer its innovative Krak debit cards to users across the UK and EU

With just one developer-friendly API, Kraken Ramp allows any platform to integrate buy/sell flows directly into their product.

The Kraken IPO is expected to occur after the SEC completes its review process, subject to market and other conditions.