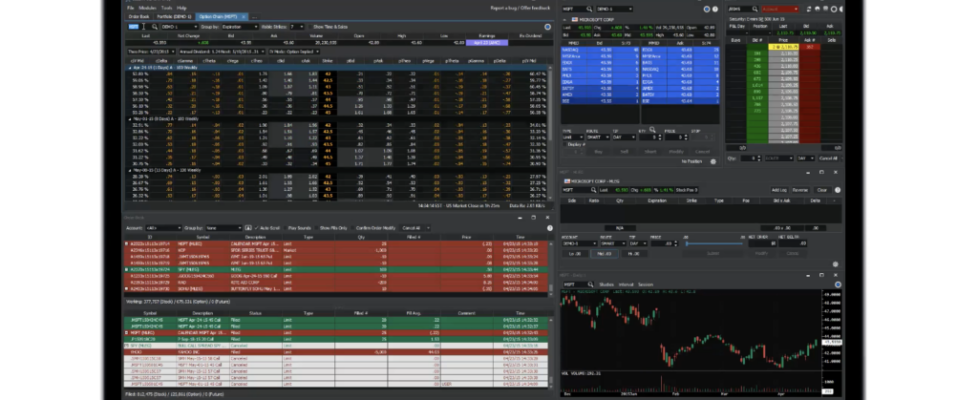

Cboe Silexx platform enhances charting underlying historical data

Cboe has unveiled another set of enhancements to Cboe Silexx, a multi-asset order execution management system (OEMS) that caters to the professional marketplace.

The latest enhancements to the platform include:

- Mid-point pricing columns have been added to the Option Chain’

- Multi and Quick Trade order tickets now support crossing on the MANUAL route;

- Charting underlying historical data now customizable by interval and chart type, and offers multiple technical indicator types.

Speaking of recent changes to Cboe Silexx, let’s note that in September the platform retired OATS reporting.

The move is in accordance with the Financial Industry Regulatory Authority’s (FINRA) rule change for Order Audit Trail System (OATS). FINRA has determined that the accuracy and reliability of the Consolidated Audit Trail (CAT) meet the standards approved by the SEC and has determined to retire OATS as of September 1, 2021.

Regarding recent updates to Silexx, let’s mention that in July Cboe Silexx enhanced Order Manager so that it now displays market data captured at time of order entry in Order Trail. Order Trail column customization has become available in Order Manager Settings.

There are also CAT reporting enhancements:

- “Sender IMID” and “FDID” fields now mutually exclusive.

- Addition of MEIR, MEIM, MEIC, and MOIR route events for firms that route internally.

- Also, “Pushed By” and “Claimed By” columns have been added to Order History.