FX week in review: Trading212 CEO resigns, AvaTrade IPO, Australia CFD rules prep

Much of our coverage of Forex Industry News this past week centered on the preparations being made by brokers down under for the new FX and CFD trading rules, set to kick in next week. Prime among those new rules, of course, is a cap on the leverage that ASIC-licensed CFD brokers can offer retail clients.

How did FP Markets, eToro, OANDA, Saxo, City Index, IG Group, and others tell their clients to prepare for the new rules? Click above or search our site, for analysis you’ll find only at FNG.

Also this week at FNG we had exclusive coverage of key executive moves in the FX sector including the departure of Trading212’s longtime CEO, AvaTrade launching an IPO, a €50,000 fine to a CySEC licensed Retail FX group, broker results, and lots more.

Some of the top FX industry news stories to appear this week on FNG included:

Exclusive: Trading 212 CEO Nick Saunders leaves. FNG Exclusive… FNG has learned that FCA regulated online brokerage Trading 212 has seen the departure of its longtime CEO Nick Saunders. Nick Saunders joined Trading 212 back in 2014 as the company’s UK compliance officer, soon after the Bulgarian based Retail FX broker expanded to the UK and received an FCA license. He was soon after promoted to CEO, and alongside the company’s co-founders and co-owners has overseen the growth of Trading 212 from £6.5 million in revenue in its first full year of operation (2015) to £56.3 million in 2018. However, the company’s fortunes took a turn for the worse in 2019 on the heels on the FCA’s CFD leverage cap, with 2019 revenue at Trading 212 falling by 47% to £29.7 million. Mr. Saunders had joined Trading 212 after spending six years at leading UK online broker IG.

Exclusive: Trading 212 CEO Nick Saunders leaves. FNG Exclusive… FNG has learned that FCA regulated online brokerage Trading 212 has seen the departure of its longtime CEO Nick Saunders. Nick Saunders joined Trading 212 back in 2014 as the company’s UK compliance officer, soon after the Bulgarian based Retail FX broker expanded to the UK and received an FCA license. He was soon after promoted to CEO, and alongside the company’s co-founders and co-owners has overseen the growth of Trading 212 from £6.5 million in revenue in its first full year of operation (2015) to £56.3 million in 2018. However, the company’s fortunes took a turn for the worse in 2019 on the heels on the FCA’s CFD leverage cap, with 2019 revenue at Trading 212 falling by 47% to £29.7 million. Mr. Saunders had joined Trading 212 after spending six years at leading UK online broker IG.

AvaTrade hires bankers for $1 billion IPO. Reported First at FNG… Retail FX and CFDs broker AvaTrade has reportedly hired investment bankers to prepare the ground for an IPO of the company later this year. AvaTrade is apparently looking at a listing in London, that could value the company at up to £700 million (USD $960 million). The investment bankers mentioned as having been hired are JP Morgan and Jefferies. Interestingly, Jefferies controls AvaTrade rival FXCM. AvaTrade has a reported client base of more than 300,000 traders, spread across 150 countries. The company is run day-to-day from Dublin by CEO Daire Ferguson, a former treasury executive at pharmaceuticals company Bristol-Myers Squibb. The company is regulated by the Central Bank of Ireland, and also has licensed subsidiaries in Australia, South Africa, Japan, the UAE, and Israel. AvaTrade is controlled by its two founding shareholders Emanuel Kronitz and Negev Nosatski.

AvaTrade hires bankers for $1 billion IPO. Reported First at FNG… Retail FX and CFDs broker AvaTrade has reportedly hired investment bankers to prepare the ground for an IPO of the company later this year. AvaTrade is apparently looking at a listing in London, that could value the company at up to £700 million (USD $960 million). The investment bankers mentioned as having been hired are JP Morgan and Jefferies. Interestingly, Jefferies controls AvaTrade rival FXCM. AvaTrade has a reported client base of more than 300,000 traders, spread across 150 countries. The company is run day-to-day from Dublin by CEO Daire Ferguson, a former treasury executive at pharmaceuticals company Bristol-Myers Squibb. The company is regulated by the Central Bank of Ireland, and also has licensed subsidiaries in Australia, South Africa, Japan, the UAE, and Israel. AvaTrade is controlled by its two founding shareholders Emanuel Kronitz and Negev Nosatski.

oneZero introduces advanced price creation tool for brokers. Multi-asset enterprise trading technology solutions provider oneZero today released the Algorithmic Pricing Module, an advanced price creation tool which facilitates the formation of customised pricing for each recipient, utilising brokers’ own data constructs and algorithms. There are many factors beyond traditional market data inputs that affect how brokers formulate their pricing to clients. While oneZero has previously offered a robust set of tools to facilitate out-of-the-box capabilities for price creation, the new Algorithmic Pricing Module gives brokers the ability to construct a price using their own proprietary algorithms which can access market data, market risk positions and other information which is unique to them.

oneZero introduces advanced price creation tool for brokers. Multi-asset enterprise trading technology solutions provider oneZero today released the Algorithmic Pricing Module, an advanced price creation tool which facilitates the formation of customised pricing for each recipient, utilising brokers’ own data constructs and algorithms. There are many factors beyond traditional market data inputs that affect how brokers formulate their pricing to clients. While oneZero has previously offered a robust set of tools to facilitate out-of-the-box capabilities for price creation, the new Algorithmic Pricing Module gives brokers the ability to construct a price using their own proprietary algorithms which can access market data, market risk positions and other information which is unique to them.

OANDA gets regulatory approval for TMS acquisition. Canadian Retail FX broker OANDA has announced that it has received regulatory approval to complete the acquisition of leading Polish CFDs broker, Dom Maklerski TMS Brokers SA (TMS). The purchase was approved by the Polish Financial Supervision Authority (KNF) earlier today. OANDA first entered into an agreement to acquire 100% of the shares of TMS Brokers in September 2020. OANDA is buying TMS from Warsaw based alternative investment firm ForeVest Capital, which acquired control of TMS in 2011. No financial terms of the transaction were released. TMS is the second largest domestic Retail FX broker in Poland, to XTB.

OANDA gets regulatory approval for TMS acquisition. Canadian Retail FX broker OANDA has announced that it has received regulatory approval to complete the acquisition of leading Polish CFDs broker, Dom Maklerski TMS Brokers SA (TMS). The purchase was approved by the Polish Financial Supervision Authority (KNF) earlier today. OANDA first entered into an agreement to acquire 100% of the shares of TMS Brokers in September 2020. OANDA is buying TMS from Warsaw based alternative investment firm ForeVest Capital, which acquired control of TMS in 2011. No financial terms of the transaction were released. TMS is the second largest domestic Retail FX broker in Poland, to XTB.

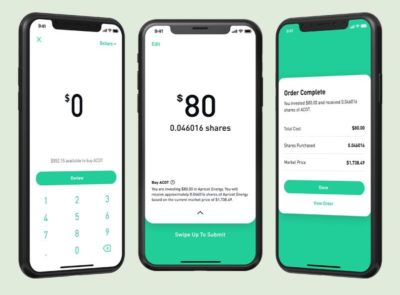

Robinhood confirms IPO filing. Online trading maverick firm Robinhood has issued a brief statement (full text below), confirming market speculation that the company had indeed filed confidential paperwork with US regulators for an initial pubic offering (IPO). While Robinhood did not disclose its choice of exchange, speculation continues that it will go the NASDAQ route, instead of the NYSE. The company also didn’t give any indication as to the valuation it expects, or the size of the offering. In its last financing round Robinhood raised $3.4 billion valuing the company in the $12-13 billion range. Last week rival eToro announced plans to go public, via a SPAC merger, at a valuation of just over $10 billion.

Robinhood confirms IPO filing. Online trading maverick firm Robinhood has issued a brief statement (full text below), confirming market speculation that the company had indeed filed confidential paperwork with US regulators for an initial pubic offering (IPO). While Robinhood did not disclose its choice of exchange, speculation continues that it will go the NASDAQ route, instead of the NYSE. The company also didn’t give any indication as to the valuation it expects, or the size of the offering. In its last financing round Robinhood raised $3.4 billion valuing the company in the $12-13 billion range. Last week rival eToro announced plans to go public, via a SPAC merger, at a valuation of just over $10 billion.

Among the top FX industry executive moves reported at FNG this week were:

❑ Exclusive: IG partnerships head Elyes Saafi moves to FOREX.com.

❑ Plus500 proposes appointment of Professor Jacob A. Frenkel as Chairman.

❑ ICM.com adds ex Forex.com, OANDA and Saxo exec Andy Ring to head China.

❑ Broctagon hires Cecilia Chan as Head of Asia FX Liquidity.

❑ Finxflo adds Mark Hope as Chief Compliance Officer.

❑ Nomura appoints Kevin Connors as EMEA Head of FX & EM.