Interactive Brokers registers 71% Y/Y jump in commission revenues in Q4 2020

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has reported its financial metrics for the final quarter of 2020, with client trading activity fueling revenues.

Interactive Brokers reported diluted earnings per share of $0.81 for the quarter ended December 31, 2020 compared to $0.57 for the same period in 2019, and adjusted diluted earnings per share of $0.69 for this quarter compared to $0.58 for the year-ago quarter.

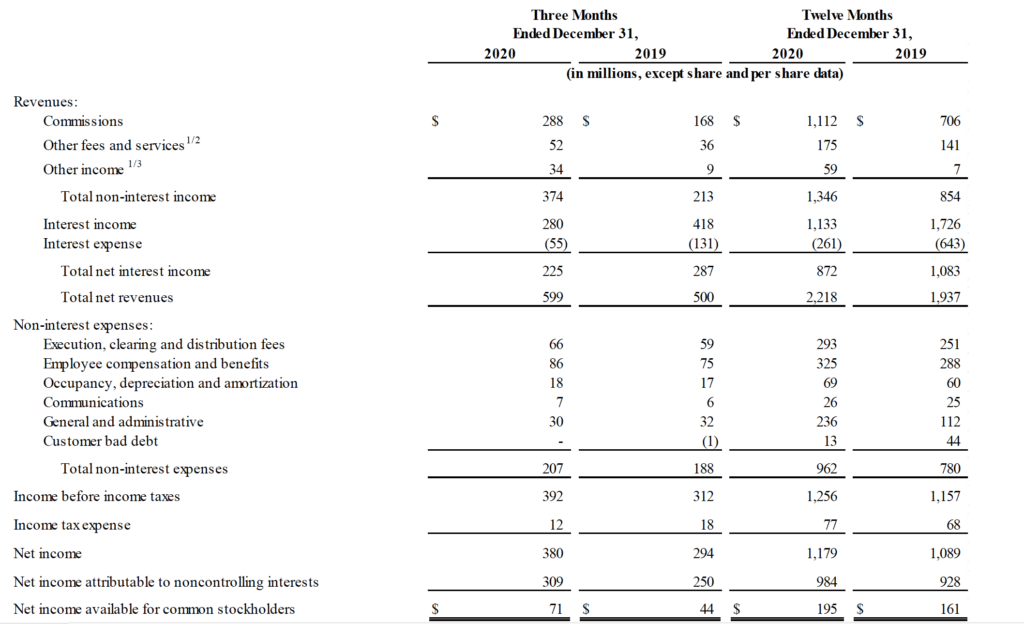

Net revenues were $599 million and income before income taxes was $392 million for the final quarter of 2020, compared to net revenues of $500 million and income before income taxes of $312 million for the equivalent period in 2019.

Adjusted net revenues were $582 million and adjusted income before income taxes was $375 million for this quarter, compared to adjusted net revenues of $503 million and adjusted income before income taxes of $315 million for the same period in 2019.

Commission revenue increased $120 million, or 71%, from the year-ago quarter on the back of higher customer trading volumes within an active trading environment worldwide. Let’s recall that commission revenue was solid in the preceding quarter too.

Net interest income, however, decreased $62 million, or 22%, from the year-ago quarter as the average Federal Funds effective rate decreased to 0.09% from 1.65% in the year-ago quarter.

Other income increased $25 million from the year-ago quarter. This increase was mainly comprised of $39 million related to Interactive Brokers’ strategic investment in Up Fintech Holding Limited (Tiger Brokers), which swung to a $32 million mark-to-market gain this quarter from a $7 million mark-to-market loss in the same period in 2019. This was partially offset by $25 million related to Interactive Brokers’ currency diversification strategy, which lost $13 million this quarter compared to a gain of $12 million in the same period in 2019.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.10 per share. This dividend is payable on March 12, 2021 to shareholders of record as of March 1, 2021.

In terms of operating metrics, let’s note that the number of customer accounts increased 56% from the year-ago quarter to 1.07 million. Total DARTs increased 165% from the year-ago quarter to 2.11 million.

The initial effects of the COVID-19 pandemic on Interactive Brokers’s financial results, which may have continued through the fourth quarter of 2020, are:

- higher commission revenue due to increased trading activity and a higher rate of customer accounts opened throughout 2020; and

- lower net interest income resulting from lower benchmark interest rates.

The impact of the COVID-19 pandemic on the company’s future financial results could be significant but currently cannot be quantified, Interactive Brokers concluded.