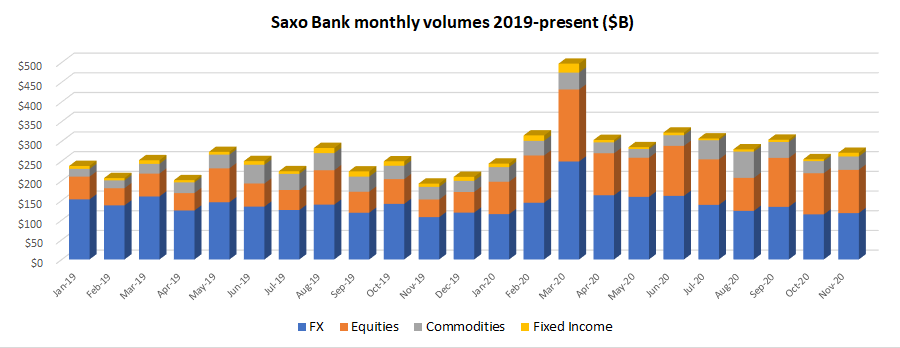

Saxo Bank FX volumes remain depressed in November 2020

After reporting one of its slowest trading months in years in October 2020, Copenhagen based Retail FX and CFDs broker Saxo Bank continued to struggle in November, with volumes up slightly but still very anemic.

Saxo Bank’s core FX trading volumes came in at $117.6 billion in November, up marginally (2.9%) from October’ s $114.3 billion which as noted was the lowest such result for Saxo since 2015, save for last November’s $107.4 billion.

Equities trading – the second largest portion of client trading volumes – came in at $109.9 billion, up 5.2% from October. Commodities trading totaled $33.9 billion, up 10.1%, while Fixed Income product trading was $9.3 billion, up 98%. Overall, November 2020 client trading volumes totaled $270.7 billion at Saxo Bank, up 6.4% from October’s $254.2 billion.

Saxo’s tepid November is even more disappointing in view of the fact that it seems to have been a banner month for FX and CFDs trading, thanks to increased currency market volatility for most of the month, and record setting equity markets trading in most corners of the globe.

As Saxo Bank looks to restart a growth phase it is focusing mainly on international markets. To that end the company took an important step during November, signing an agreement with UAE based Sarwa, the MENA region’s first online investment advisory platform for young professionals. The company also took steps to shed non-core assets, with its BinckBank unit selling a large amount of non-core mortgage portfolio assets.

Saxo Bank is controlled by China’s Geely Group, which bought a majority interest in the company in 2018.