Cboe registers 22% Y/Y increase in global FX revenue in Q4 2025

Cboe Global Markets, Inc. today reported financial results for the fourth quarter of 2025 and full year.

Record Global FX net revenue of $23.7 million increased $4.3 million, or 22%, from the fourth quarter of 2024. The increase was due to higher net transaction and clearing fees.

ADNV traded on the Cboe FX platform was $53.3 billion for the quarter, up 17% compared to last year’s fourth quarter, and net capture rate per one million dollars traded was $2.95 for the quarter, up 8% compared to $2.72 in the fourth quarter of 2024.

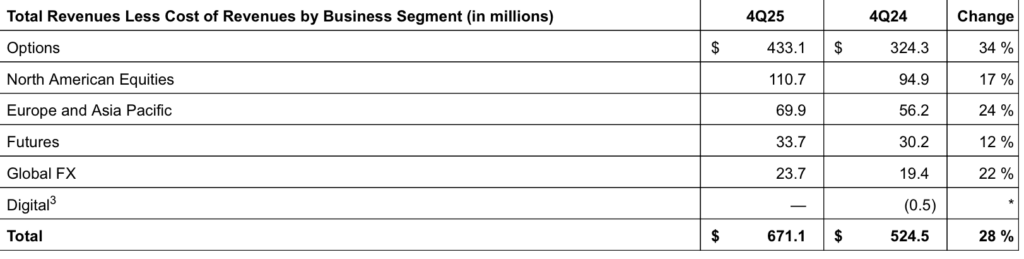

Total revenues less cost of revenues of $671.1 million increased 28%, compared to $524.5 million in the prior-year period, a result of increases across all net revenue captions.

Total operating expenses were $267.3 million versus $226.0 million in the fourth quarter of 2024, an increase of $41.3 million. This increase was primarily due to the impairment of assets and higher compensation and benefits, driven by an increase in accrued bonuses as a result of strong company performance in the fourth quarter of 2025.

Adjusted operating expenses1 of $220.6 were up $15.8 million compared to $204.8 million in the fourth quarter of 2024. This increase was primarily due to higher compensation and benefits, driven by an increase in accrued bonuses as a result of strong company performance.

Diluted EPS for the fourth quarter of 2025 increased 60 percent to $2.97 compared to the fourth quarter of 2024. Adjusted diluted EPS of $3.06 increased 46 percent compared to 2024 fourth quarter results.

“Cboe delivered an exceptional fourth quarter, marking the culmination of a year characterized by record growth – including 17 percent net revenue growth, 45 percent diluted EPS growth, and 24 percent adjusted diluted EPS1 growth,” said Craig Donohue, Chief Executive Officer of Cboe Global Markets. “Our recent strategic realignment is enabling us to allocate more resources toward growth and value creation in our core businesses, while also better positioning Cboe to capitalize on emerging opportunities. We are starting 2026 with a very strong foundation – a focused growth strategy, a highly seasoned and impressive leadership team, and continued strong secular trends in our core businesses.”

“Cboe produced another quarter of record net revenue, diluted EPS, and adjusted diluted EPS1 to conclude an extraordinary year,” said Jill Griebenow, Cboe Global Markets Executive Vice President, Chief Financial Officer. “In our Derivatives business, record volumes across our index and multi-listed options products drove robust net revenue growth of 38 percent versus the fourth quarter of 2024. Cash and Spot Markets net revenue rose 27 percent, and Data Vantage net revenue increased 9 percent on a year-over-year basis. Moving forward, we anticipate 2026 total organic net revenue growth2 will be in the ‘mid single-digit’ range, and we anticipate 2026 Data Vantage organic net revenue growth2 will be in the ‘mid to high single-digit’ range. In addition, we are introducing our full year 2026 adjusted operating expense guidance2 range of $864 million to $879 million. We are pleased with the record results we achieved in 2025, and we remain focused on driving durable shareholder returns in the year ahead.”