Intercontinental Exchange registers 6% Y/Y rise in revenues in Q3 2020

Operator of global exchanges and clearing houses and provider of mortgage technology, data and listing services Intercontinental Exchange Inc (NYSE:ICE) today posted its financial results for the third quarter of 2020.

Third quarter consolidated net revenues were $1.4 billion, up 6% year-over-year, including $75 million related to the acquisition of Ellie Mae. Data and listings revenues in the third quarter were $700 million and trading and clearing net revenues were $711 million.

Consolidated operating expenses were $784 million for the third quarter of 2020 and included $56 million of expenses related to Ellie Mae. On an adjusted basis, consolidated operating expenses were $611 million and included $29 million of expenses related to Ellie Mae.

Consolidated operating income for the third quarter was $627 million and the operating margin was 44%. On an adjusted basis, consolidated operating income for the third quarter was $800 million and the adjusted operating margin was 57%.

Third quarter data and listings revenues were $700 million, including data revenues of $589 million and listings revenues of $111 million. On a constant currency basis, segment revenues were up 5% with data revenues up 6% year-over-year. Segment operating income for the third quarter was $322 million and the operating margin was 46%. On an adjusted basis, operating income was $371 million and the adjusted operating margin was 53%.

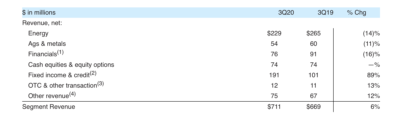

Third quarter trading and clearing net revenues were $711 million, up 6% from one year ago and included $75 million of revenue related to Ellie Mae. Trading and clearing operating expenses were $406 million and adjusted operating expenses were $282 million in the third quarter. Segment operating income for the third quarter was $305 million and the operating margin was 43%. On an adjusted basis, operating income was $429 million and the adjusted operating margin was 61%.

- Energy futures and options revenue in the third quarter decreased (14%) year-over-year due to a (8%) decrease in average daily volume (ADV) and a (6%) decrease in rate per contract (RPC).

- Ags and metals futures and options revenue in the third quarter decreased (11%) year-over-year driven by an (9%) decrease in ADV and a (2%) decrease in RPC.

- Financials futures and options revenue in the third quarter decreased (16%) year-over-year reflecting a (24%) decrease in ADV and partially offset by a 9% increase in RPC.

- U.S. cash equities and equity options revenue in the third quarter was flat year-over-year reflecting, in part, a 29% increase in cash equities ADV offset by a (21%) decrease in RPC.

In terms of outlook, ICE expects its fourth quarter 2020 Data Services revenues to be in a range of $590 million to $595 million. ICE’s diluted share count for the fourth quarter is expected to be in the range of 562 million to 568 million weighted average shares outstanding.