Exclusive: BP Prime sees 7x Revenue jump in FY2024 to £16M in refocus on Professional clients

FNG Exclusive… FNG has learned via regulatory filings that FCA regulated Black Pearl Securities Limited, which operates the BP Prime online trading brand, has seen a huge, nearly seven-times rise in its Revenues in fiscal year 2024 (year ended March 31), as the company rebranded and refocused on Institutional and Professional clients.

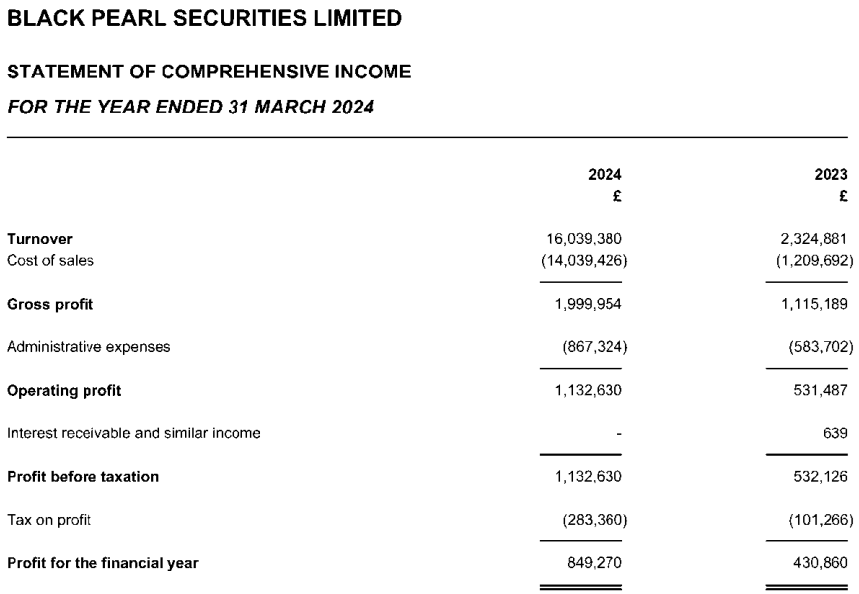

Revenues at BP Prime came in at £16.0 million in FY2024, up by 590% from £2.3 million. Net Profit for FY2024 was £849K about double 2023’s £430K.

The company said that its institutional product offering to regulated entities and professional clients has been predominantly responsible for driving income. The retail product saw a decline in account applications and consequent reduction in profit contribution. Both sectors. professional and retail, remain highly competitive in the marketplace. BP Prime underwent a rebrand during the year, refreshing its logo and launching a new website (bpprime.com).

As far as future developments go, BP Prime said it continues to look for opportunities both in the UK and overseas. The company continues to market its key product to regulated institutional clients and is optimistic of success. The company is also seeking to reinvigorate its retail product in China with the introduction of a new CRM, local website and region-specific payment gateways.

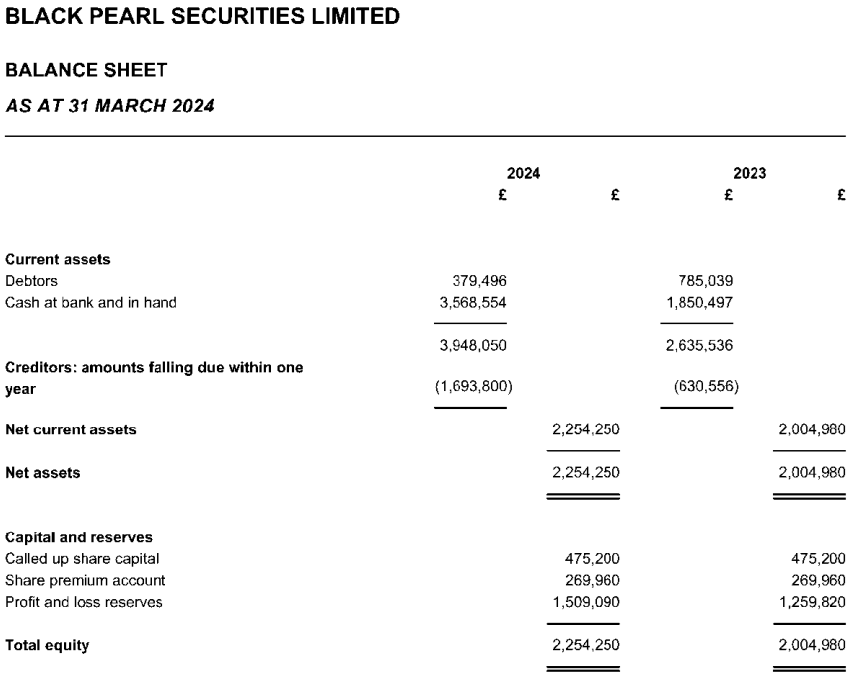

At 31 March 2024, amounts held by the company on behalf of clients in accordance with the Client Assets Rules of the Financial Conduct Authority amounted to £2,181,447 (2023: £1,651 ,589).

Black Pearl Securities and BP Prime are controlled by Vladimir Gesperik, a Slovak entrepreneur now resident in the UAE. Mr. Gesperik also operates offshore (Labuan) CFDs broker Golden Brokers.

BP Prime’s FY2024 income statement and balance sheet follow below.