TradingView introduces Volume footprint chart type

TradingView has added Volume footprint to the lineup of chart types.

The new Volume footprint chart type for Premium and higher-tier plans shows the distribution of trading volume across several price levels within each bar. The information from this chart type helps traders analyze the buying/selling balance across levels within each bar and identify areas of significant liquidity.

To view volume footprints on your chart, select “Volume footprint” from the chart type dropdown menu:

The chart will display a footprint for each bar with available intrabar volume data:

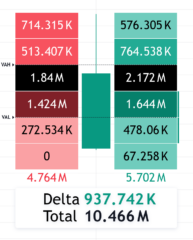

The default view visualizes the distribution of selling volume at the left of each bar and buying volume at the right. The gradient colors reflect the relative intensity of each level’s selling and buying volume, and the lines next to the distributions indicate levels of significant imbalance.

Each side of the footprint also highlights the Point of Control (POC), i.e., the level with the highest trading volume. In addition, the chart displays volume delta and total volume information below each bar.

Comparing the volume values from both sides of a footprint allows you to assess the balance between buying and selling activity across levels and evaluate how the distribution of trading activity relates to price action. Unpacking bars this way can provide a more granular view of what happens during a bar’s evolution and help you determine how strongly buyer or seller pressure supports price movements.

TradingView has recently added two new volume-based indicators, Volume Delta and Cumulative Volume Delta.

These indicators use intrabar volume and price fluctuations to estimate the difference (delta) between buying and selling pressure within each chart bar, providing insight into an instrument’s sentiment and market dynamics.