Aquis Exchange expects to report performance for FY23 in line with Board expectations

Aquis Exchange PLC (LON:AQX) today provided an unaudited trading update for the year ended 31 December 2023 (“FY23”).

Aquis confirms that it expects to report performance for FY23 in line with Board expectations.

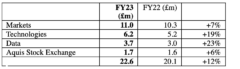

Net revenue is up 12% to £22.6 million (FY22 £20.1m).

Profit before tax increased 16% to £5.2 million (FY22 £4.5m).

Aquis Markets increased market share following change to proprietary trading rule in November 2023. The overall pan-European market share for December 2023 was 4.97%, up from 4.76% in November and 4.58% in October 2023. The January 2024 average to date is 5.21%.

Aquis Technologies was awarded two new technology contracts in 2023, including one for a central bank. In addition, an existing contract moved from design and consultancy to exchange delivery stage. The division now has nine contracts, seven of which have recognised revenue.

Aquis Data increased revenue by over 20% from the sale of Aquis Markets and Aquis Stock Exchange data to non-Member market participants. Aquis continues to expect significant benefit from the advent of EU and UK consolidated tapes.

Aquis Stock Exchange admitted 16 new companies in 2023.

Alasdair Haynes, CEO, Aquis Exchange PLC said:

“In a year marked by uncertainty and difficult market conditions, I am really pleased to report another year of double-digit revenue growth for Aquis Exchange, alongside many successful strategic developments for the Group for which we expect to see the benefits in both near and long term. We are well positioned for the future and look forward to delivering throughout 2024 and beyond.”