TradingView announces enhancements to B3 futures data

TradingView today announced several updates of the futures data from B3, one of the leading global exchanges.

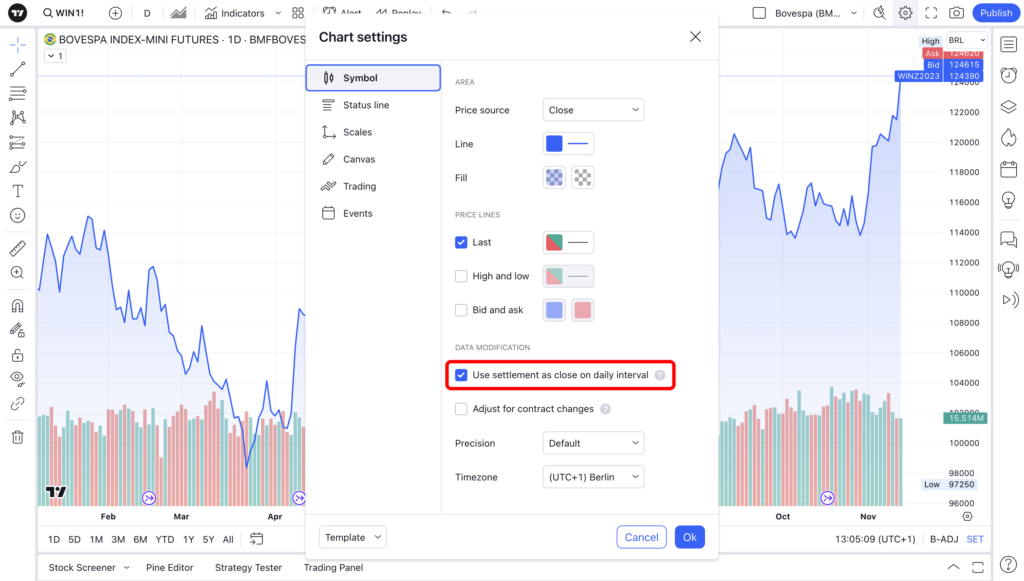

- Settlement price

Now, TradingView users have the flexibility to switch between Settlement and Last prices as the closing value for contracts. You can do this simply by pressing the SET button located at the bottom of the chart or selecting the Use settlement as close on daily interval option in the settings.

The Settlement price is a value determined by the exchange at the close of each trading day, it is based on the averages of final asks and bids. Switching between Settlement and Last prices can aid in a better understanding of gains and losses in your position. However, it’s important to note that the settlement price is not reflected on intraday intervals.

- Back-adjustment

Another notable feature now available for B3 futures is back-adjustment. It allows you to back-adjust previous contracts in continuous futures, eliminating the roll gap resulting from price differences in different contracts. To access this feature, use the B-ADJ button at the chart’s bottom or go to the settings and activate the Adjust for contracts changes checkbox.

- Open interest

Finally, TradingView has introduced the capability to track Open Interest values for B3 futures. This metric indicates the total number of outstanding derivative contracts awaiting settlement, offering valuable insights into futures evaluation. To view this data, navigate to the Indicators, Metrics & Strategies menu and select the Open Interest indicator.

The TradingView platform reliably connects to hundreds of data feeds, with direct access to 1,357,880 instruments from all over the world.