Robinhood revenues rise 7% ($989M) and profits up 15% ($386M) in bounceback Q2 2025

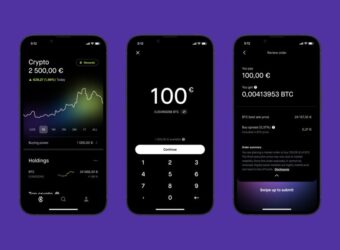

The Revenue increase came as Crypto trading Revenue fell at Robinhood from $252 million in Q1 to just $160 million in Q2 2025.

The Revenue increase came as Crypto trading Revenue fell at Robinhood from $252 million in Q1 to just $160 million in Q2 2025.

Robinhood’s Board of Directors increased the company’s share repurchase authorization by $500 million, to $1.5 billion.

Driving Robinhood’s growth were soaring Crypto revenues of $358 million in Q4 versus just $61 million in Q3.

Aftermarket trading Wednesday saw Robinhood shares changing hands at about $25, down 11.4%.

The largest individual Revenue item for Robinhood is now actually Interest income, up 22% year-over-year to $285 million.

Robinhood transaction-based revenues increased 59% YoY to $329 million, driven by cryptocurrencies revenue of $126 million, up 232%.

For the full year 2023 Revenues at Robinhood came in at $1.87 billion, up 37% year-over-year.

Robinhood revenues increased 10% sequentially to $486 million, primarily due to seasonally higher proxy revenue and higher net interest.