How major FX and CFD brokers adapt to IBOR transition

FX News Group reviews how some of the world’s major Forex and CFD brokers adapt to IBOR transition.

Forex.com is one of the oldest and most recognizable brands in online Retail FX and CFD trading. It was the leading brand of publicly traded brokerage Gain Capital Holdings Ltd., which also operated City Index in the UK and the GTX institutional FX trading operation.

Bedminster, NJ based Gain Capital was acquired by StoneX Group (Nasdaq:SNEX), formerly INTL FCStone, in July 2020 for $236 million, and since then Forex.com is a unit of StoneX.

Forex.com trading volumes have averaged about $200 billion per month in 2020.

FX News Group reviews how some of the world’s major Forex and CFD brokers adapt to IBOR transition.

FOREX.com Japan plans to raise the required margin for USD/TRY, TRY/JPY and EUR/TRY, effective December 30, 2021.

FOREX.com warns that the Turkish lira (TRY) is volatile due to political and economic events, so certain restrictions may be imposed.

StoneX reported operating revenues from FX/CFD contracts of $55.7 million in the three months to end-September 2021.

StoneX, the new owner of the FOREX.com brand, has confirmed that the retail FX broker launched operations in Latin America.

Japanese FX broker FOREX.com plans to change the margin requirements for five HKD currency pairs, including USD/HKD.

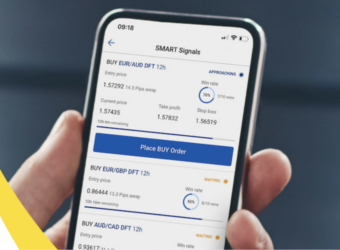

City Index and Forex.com now offer SMART Signals – powerful, AI-driven trade ideas for clients of the retail FX brokerages.

GAIN Capital manages to escape a lawsuit over alleged consumer fraud in relation to negative crude oil prices.

The $236 million StoneX-Gain Capital acquisition has been looking better and better each quarter for the company.

Tim O’Sullivan has been with Gain Capital for 21 years, joining as Chief Dealer in 2000 when the company was just a year old.