XTB sees slowdown in Revenues (-1%) and Profits (-6%) in Q4 2024

Following a strong Q3, Poland based Retail FX and CFDs broker XTB (WSE:XTB) has reported its preliminary results for Q4 and the full 2024 year, indicating a slower Q4 on both the top and bottom line (also when compared to Q4 2023), although overall the company had a fairly impressive 2024.

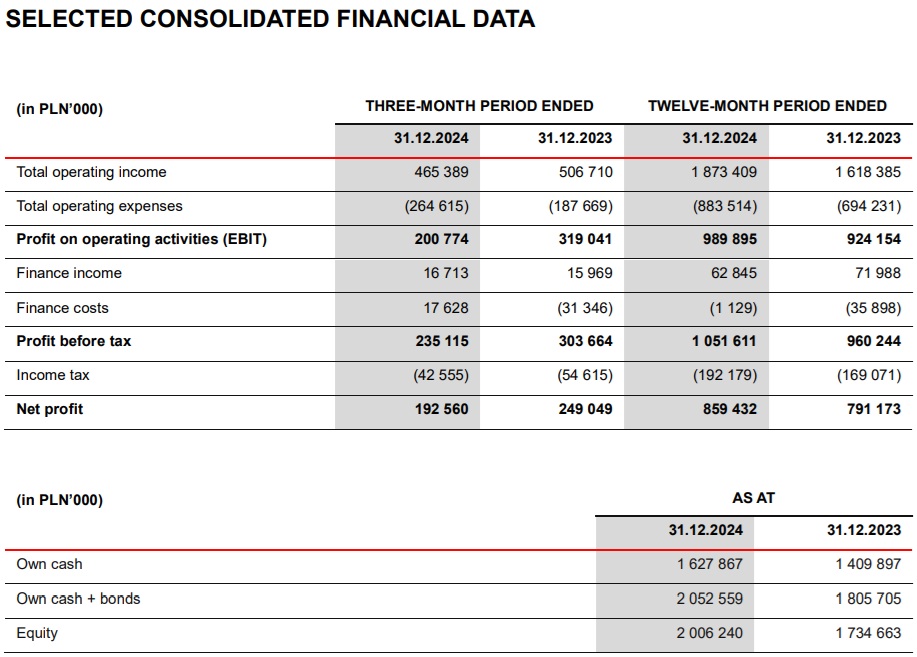

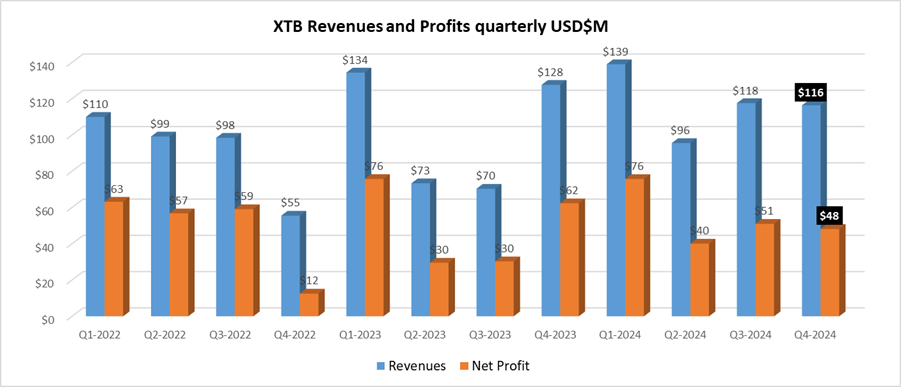

XTB Revenues and Profits 2024

Revenues at XTB for the fourth quarter of 2024 came in at PLN 465 million (USD $116 million), down slightly by 1% from Q3’s $118 million. Net Profit fell by 6% QoQ, to PLN 193 million ($48 million), versus $51 million in Q3. For the full year 2024, Revenues at XTB were PLN 1,873 million ($468 million), and Net Profit was PLN 859 million ($215 million) – improvements in both measures from 2023.

XTB Trading Volumes 2024

Trading volumes at XTB averaged $242 billion monthly in Q4-2024, up 4% from $232 million per month in Q3-2024. The company’s profitability per 1 million USD transaction volume in Q4 however fell to 157, from 174 in Q3. For the full year 2024, XTB averaged $219 billion in monthly client trading volumes.

XTB Client Acquisition 2024

XTB said that it has a solid foundation in the form of a constantly growing client base and the number of active clients. In 2024, the Group achieved another record in this area, acquiring 498,438 new clients compared to 311,971 a year earlier, an increase of 59.8%. Similarly to the number of new clients, the number of active clients was also a record and it increased from 408,528 to 658,520, up 61.2% y/y.

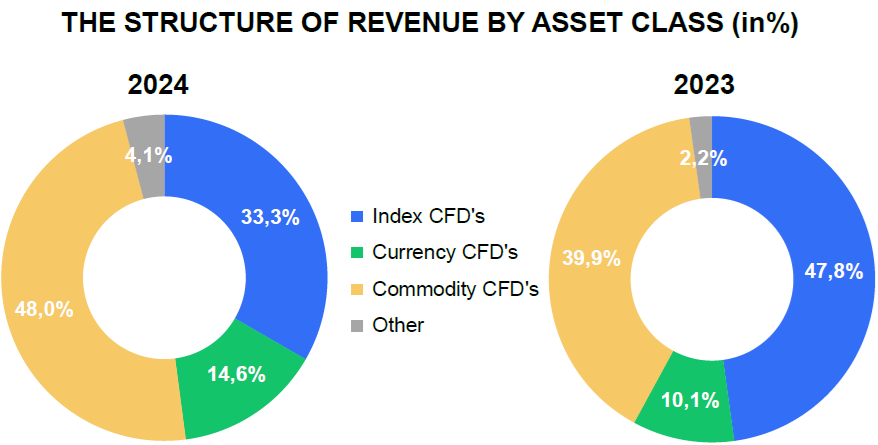

XTB Asset Classes Traded 2024

Looking at the structure of revenues generated in terms of instrument classes, it can be seen that in 2024, CFDs (contract for difference) based on commodities led the way. Their share of revenue in the period under review was 48.0% (2023: 39.9%). This is a consequence of, among other things, high profitability on CFDs based on gold, natural gas and cocoa price quotations. The second most profitable asset class was CFDs based on index. Their share in the revenue structure reached 33.3%, compared to 47.8% the year before. This was due to due to the high profitability of trading in CFDs based on the US 100 index, the German DAX equity index (DE40) or the US 500 index. Revenue from CFD instruments based on currencies represented 14.6% of total revenue, up from 10.1% a year earlier. The most profitable financial instruments in this class were CFDs based on the bitcoin cryptocurrency and the USDJPY currency pair.

XTB Expenses 2024

Operating expenses in 2024 amounted to PLN 883,5 million, PLN 189,3 million higher than in the same period of the previous year (2023: PLN 694,2 million). The most significant changes were in:

- marketing costs, an increase of PLN 78,2 million, mainly due to higher expenses for online marketing campaigns;

- salaries and employee benefits, an increase of PLN 52,4 million, mainly due to an increase in the number of employees;

- commission costs, an increase of PLN 35,5 million, as a result of higher amounts paid to payment service providers through which clients deposit their funds on transaction accounts;

- other external services, an increase of PLN 14,7 million, mainly due to higher expenses for IT systems and licenses (an increase of PLN 12,5 million y/y).

On a q/q basis, operating expenses were higher by PLN 56,1 million, mainly driven by a PLN 42,6 million increase in online and offline marketing activities, followed by a PLN 5,2 million increase in salary expenses and employee benefits costs, mainly resulting from an increase in employment, as well as a PLN 3,9 million increase in commission expenses resulting from higher amounts paid to payment service providers through which clients deposit their funds on transaction accounts. These expenses are increased gradually, and the activities for which the Company allocates them are closely related to the implementation of its strategic objectives.

Due to the dynamic development of XTB, the Management Board estimates that the total operating expenses in 2025 could be up to approximately 40% higher than what was observed in 2024. The priority of the Management Board is to continue growing the client base and building the global brand. As a consequence of the implemented activities, marketing expenditures may increase by about 80% compared to last year, while assuming that the average cost of acquiring a client should be compared to what was observed in 2023 – 2024.

XTB Plans for 2025

In 2025, XTB said it will continue its strategy of building a universal investment application with an offering for every investor who wants to effectively manage their funds, both in the short and long-term. The company plans to introduce retirement and long-term investment products – such as an IKZE account in Poland and a PEA account in France which allows investment in European equities and ETFs under a tax shelter.

XTB will continue to develop the eWallet service, which provides instant access to funds, combining investments with convenient payments. The company plans not only to launch the service in other European markets, but also to systematically add more currencies and facilities for investors using the card (including instant payments, transaction classification and travel facilities such as access to VIP lounges at airports).

The company also sees potential for further development of the active investor product segment. XTB is in the process of preliminary analyses and preparatory work related to the introduction of options. It is also the Company’s intention to offer investors the opportunity to trade cryptocurrencies. In anticipation of the enactment of a law adapting Polish regulations to the MiCA Regulation, XTB has been working on both the development of the necessary legal documents and the introduction of technological changes to the application and the XTB platform that will allow cryptoassets to be added to the offering.

XTB’s Management Board released the following statement about the company’s 2024 results:

“In 2024, XTB successfully implemented the goals of its strategy, working to constantly expand its client base. The following quarters presented the effectiveness of the implemented activities, which made it possible to acquire a record nearly 500 thousand new clients in the year under review, an increase of 59,8% y/y. At the same time, the number of active clients increased by 61,2% y/y from 408,5 thousand to 658,5 thousand.

“In building its operating growth, XTB expertly took advantage of the continuing trends of interest in financial instruments and alternative investments such as stocks, bonds and cryptocurrencies in global markets, which was associated with low interest rates in many countries and persistently high inflation. Using its potential, the company was committed to popularising financial literacy and expertly tapped into the megatrend related to the use of mobile applications, creating and providing its clients with a modern investment tool that enables easy portfolio management, tracking of financial markets and real time transactions. All this has contributed to XTB’s successive record financial and operational results.”

More highlights from XTB’s 2024 results follow below.