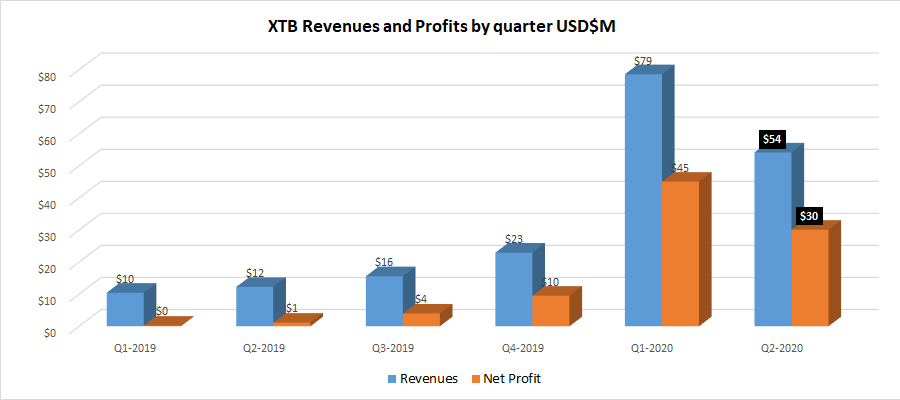

XTB sees 31% drop in Q2 Revenues to $54 million

Continuing a theme we are seeing from a number of leading Retail FX brokers worldwide, Poland based XTB is reporting a set of very strong results for the first half of 2020, although Q2 is noticeably slower than Q1.

Q1 saw XTB report revenues of PLN 307 million (USD $79 million), which was more than XTB brought in for all of 2019. Like at a number of other Retail FX brokers, Q1-2020 client trading volumes (and resultant company revenue) was supercharged by the extreme market volatility from late February through the end of March, at the outset of the global Covid-19 crisis.

Q2 was certainly still very good in overall historical terms at XTB, with Revenue of PLN 211 million (USD $54 million) and net profit of PLN 118 million (USD $30 million), but both those figures were more than 30% below Q1.

The increase in activity at XTB also bodes well for the future. In the 1H-2020 period the group noted a record

number of new clients at over 52,000, compared to 16,000 a year earlier – an increase of 225.9% YoY.

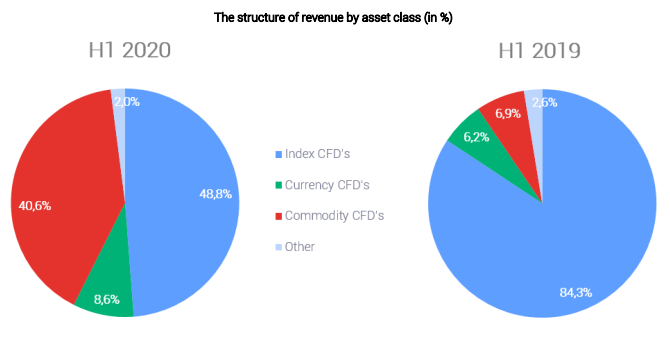

Another interesting note for client trading in 1H-2020 is the change in asset mix. Looking at XTB’s revenues by asset class traded, stock index CFDs still dominated but were a much lower proportion of client trading in the first half of 2020, at 48.8% versus 84.3% a year earlier. This overall dominance of index CFDs at XTB is a consequence of the high interest of XTB clients in CFD instruments based on the German DAX stock index (DE30) and the US indices US500, US100 and contract based on the volatility index listed on the U.S. market.

The second most profitable class of assets were CFDs based on commodities. Their share in the structure of revenues on financial instruments in the first half of 2020 rose to 40.6%, versus just 6.9% in 2019. The most profitable instruments among this asset class were CFD instruments based on oil prices, gold and natural gas contracts. Revenues of CFDs based on forex were just 8.6% of all revenues, compared to 6.2% a year earlier.

XTB said that its clients, looking for investment opportunities to earn money, generally trade in financial instruments that are characterized by high market volatility in a given period. This may lead to fluctuations in the revenue structure by the asset class, which should be treated as a natural element of the business model. From the point of view of XTB, it is important that the range of financial instruments in the Group’s offer is as broad as possible and allows clients to use every upcoming market opportunity to earn money.

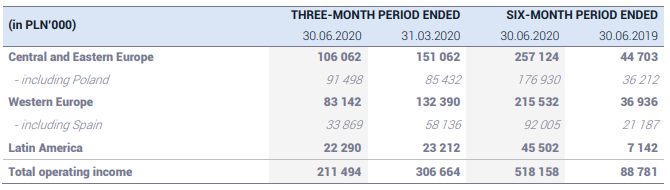

XTB said that it places great importance on the geographical diversification of revenues. The countries from which the Group derives more than 15% of revenues are Poland and Spain with a share of 34.1% (H1 2019: 40.8%) and 17.8% (H1 2019: 23.9%) respectively. The share of other countries in the geographical structure of revenues does not exceed in any case 15%.

XTB’s full preliminary report for 1H-2020 can be seen here (pdf).