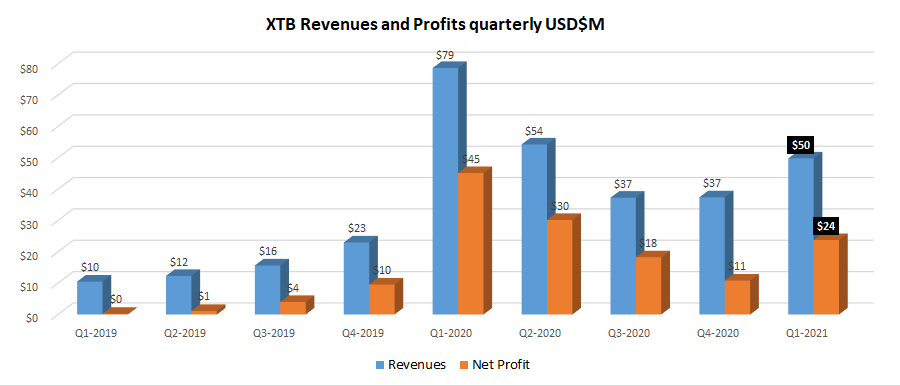

XTB revenues up 33% in Q1-2021 to $49 million

Following a fairly disappointing second half of 2020, Poland based Retail FX and CFDs brokerage house X Trade Brokers Dom Maklerski SA – operator of the XTB.com and X Open Hub brands – has released preliminary financial results for Q1-2021 indicating a significant pickup in activity and profitability.

Revenues at XTB were up 33% in Q1 over Q4-2020, at PLN 186.7 million (USD $49 million). Net profit for the quarter was PLN 89.0 million (USD $24 million), up 120% from Q4’s PLN 40.5 million.

Like many FX/CFD brokers, XTB had an absolute fantastic first-six-months of 2020, as market volatility (and client trading volumes) soared in the wake of the COVID-19 crisis. However unlike some of its peers activity waned in both Q3 and Q4, and along with it XTB shares.

XTB released the results after markets closed on Friday. It will be interesting to note how the stock market reacts to the news come Monday. XTB shares (WSE:XTB) had actually traded down sharply by about 17% over the past week in anticipation of the Q1 results announcement.

Some more info on XTB’s Q1… The company signed up 67,231 new clients – a new record for the company – and saw a total of 103,425 active clients during the quarter.

XTB saw client trading volumes of USD $386.3 billion during Q1, or $128 billion monthly.

Looking at revenues in terms of the classes of instruments, XTB said that in Q1 2021 CFDs based on commodities dominated. Their share in the structure of revenues on financial instruments reached 53.8%, versus 51.2% a year earlier. The company said that this is a consequence of the high interest of XTB clients in CFD instruments based on gold, silver and oil prices. The second most profitable class were CFD instruments based on indices. Their share in the structure of revenues in Q1 2021 reached 39.9% (Q1 2020: 36.2%). The most profitable instruments among this asset class were instruments based on the German DAX stock index (DE30) and American stock index US 100. Revenues of CFD based on currencies was just 2.7% of all revenues, compared to 11.1% a year earlier.

XTB did a higher concentration of revenue geographically in Q1 versus last year, with the company’s core Central and Eastern Europe geo comprising 59% of revenue, versus 49% in Q1-2020.

Despite the increased concentration, XTB said that international expansion remains a key goal for the company, with efforts focused on the start of operational activities in the United Arab Emirates and the Republic of South Africa. At the end of November 2020 XTB received preliminary approval of the DFSA regulator to conduct brokerage activities in the UAE. It is an approval of the “in principal” type, that requires the fulfilment of conditions (mainly operational) before the actual start of operations. One of the conditions was the establishment of the company XTB MENA Limited in the DIFC (Dubai International Financial Centre) which took place on 9 January 2021. The process is currently underway over the fulfilment of other conditions.

The intention of the XTB Management Board is to start operating activities in the United Arab Emirates in the first half of 2021.

In terms of the Republic of South Africa, due to the complex local formal and legal conditions, the Management Board said it is currently not able to indicate the expected date of the start of operations in this market. Subsidiary XTB Africa (PTY) has been in the licensing process since February 2019.

XTB also noted that while it would entertain growth via acquisitions, the company is currently not involved in any acquisition process.