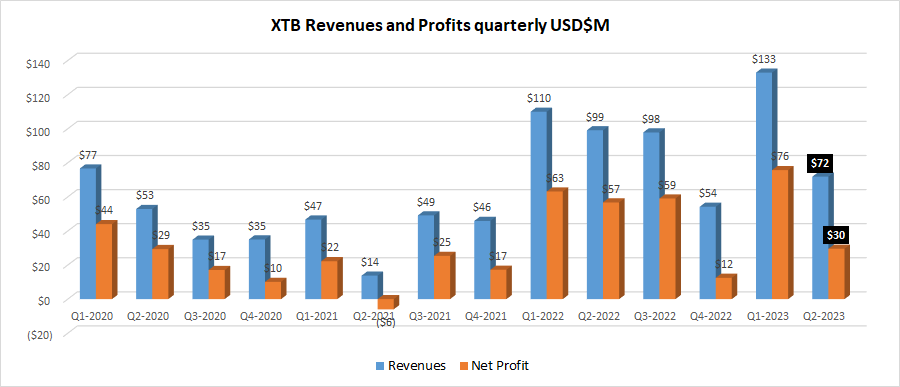

XTB revenues (-46%) and profits (-61%) slow down in Q2-2023 after record Q1

After posting record Revenues and Profits in a quite torrid Q1, activity slowed down somewhat in Q2 at Poland based Retail FX and CFDs broker XTB (WSE:XTB), yet the company still posted very strong results for the first half of the year.

XTB Q2 2023 Revenues and Profits

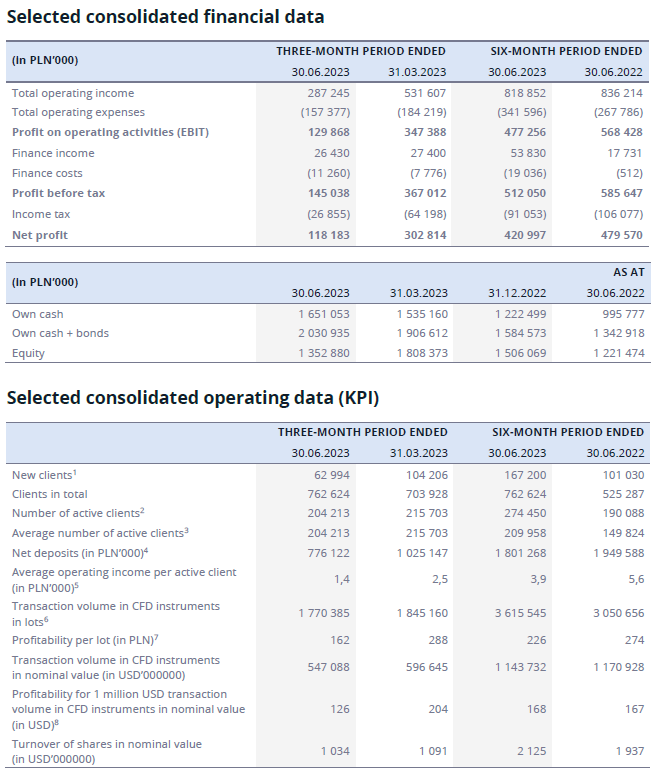

After seeing Revenues of USD $133 million and Net Profit of $76 million in Q1, XTB reported that Q2’s Revenue came in at PLN 287.6 million, or USD $72 million, down 46% quarter-on-quarter. Similarly profit came in at PLN 118.2 million, or USD $30 million, down 61% from Q1.

Overall for 1H-2023, Revenues totaled $205 million and Net Profit $105 million at XTB.

XTB noted that during the first six months of the year the Group acquired a record 167.2 thousand new clients, while the number of active clients increased by 44.4% y/y from 190.1 thousand to 274.5 thousand.

XTB trading volumes and profitability

Regarding revenues, in the first half of 2023 the Group’s revenue decreased by 2.1% y/y, from PLN 836.2 million to PLN 818.9 million. Contributing to this decline was a lower profitability per lot of PLN 48, amounting to PLN 226 (H1 2022: PLN 274). This decrease is mainly the result of lower volatility in the financial and commodity markets in Q2 2023, compensated in part by the constantly increasing number of new clients (increase by 65.5% y/y), combined with their high transactional activity expressed in the number of CFD contracts concluded in lots. Consequently, trading in derivatives amounted to 3 615.5 thousand lots (H1 2022: 3 050.7 thousand lots).

Monthly trading volumes averaged $182 billion monthly at XTB during Q2 2023, versus $199 billion / month in Q1.

XTB management strategy

The company noted that the priority of the Management Board is to further increase the client base leading to the strengthening of XTB’s market position globally by reaching its product offering to the mass client. The ambition of the Management Board in 2023 is to acquire, on average, at least 40-60 thousand new clients per quarter. These activities are supported by a number of initiatives, including the offer, introduced on April 11, 2023, to invest in the Romanian market (expanded in other markets, including: the Portuguese, Czech, Slovak, Polish, Italian or Spanish markets) in company shares and ETFs for a fraction of their price.

Fractional shares allow greater flexibility and control over investments. This makes it easier for clients to tailor their investment portfolio to their own unique financial goals and risk tolerance. Following the ongoing activities, the Group acquired a total of 104.2 thousand new clients in the first quarter of 2023, and nearly 63.0 thousand new clients in the second quarter of this year. In addition, 18.4 thousand new clients were acquired in the first 25 days of July 2023.

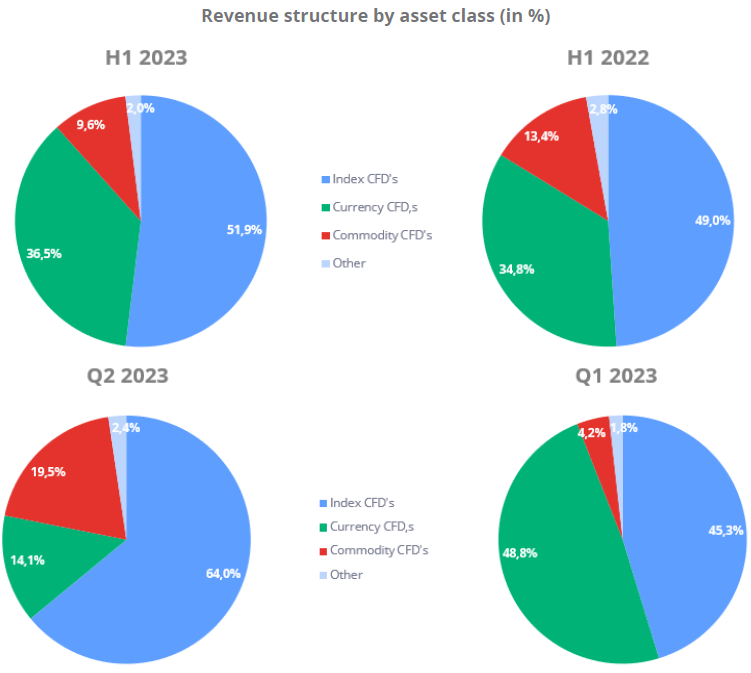

Activity by asset class

Looking at XTB’s revenues in terms of the classes of instruments responsible for their creation, it can be seen that CFDs based on indices led in the first half of 2023. Their share in the structure of revenues on financial instruments reached 51.9%. This is a consequence of the high profitability on CFDs instruments based on the US 100 index, the German DAX stock index (DE30) or US 500 index. The second most profitable asset was CFD instruments based on commodities. Their share in the revenue structure in the first half of 2023 was 36.5%. The most profitable instruments in this class were CFDs based on natural gas and gold quotation. Revenues on CFDs instruments based on currencies accounted for 9.6% of total revenues, where the most profitable financial instruments in this class were those based on the USDJPY and EURUSD currency pair.

XTB business model

The business model used by XTB combines features of the agency model and the market maker model, in which the Company is a party to transactions concluded and initiated by clients. XTB does not engage in proprietary trading for its own account in anticipation of changes in the price or value of the underlying instruments (so-called proprietary trading).

The hybrid business model used by XTB also uses an agency model. For example, on most CFD instruments based on cryptocurrencies, XTB hedges these transactions with third-party counterparties, virtually ceasing to be the other party to the transaction (legally, of course, it is still XTB). The Company’s fully automated risk management process limits exposure to market changes and forces it to hedge positions in order to maintain appropriate levels of capital requirements. In addition, XTB executes directly on regulated markets or alternative trading venues all transactions in shares and ETFs and CFDs instruments based on these assets. XTB is not a market maker for this class of instruments.

It is inherent in XTB’s business model that revenues are highly volatile from period to period. Operating results are affected primarily by: (i) volatility on financial and commodity markets; (ii) the number of active clients; (iii) the volume of their transactions in financial instruments; (iv) general market, geopolitical and economic; (v) competition in the FX/CFD market and (vi) the regulatory environment.

As a general rule, the Group’s revenues are positively affected by higher activity in the financial and commodity markets due to the fact that in such periods see higher levels of trading by the Group’s clients and higher profitability per lot. Periods of clear and long market trends are favourable for the Company and it is at such times it achieves the highest revenues. Therefore, the high activity of the financial and commodities markets generally leads to increased trading volume on the Group’s trading platforms. Conversely, a decrease in this activity and the related decrease in trading activity of the Group’s clients generally leads to a decrease in the Group’s operating income. Accordingly, the Group’s operating income and profitability may decline during periods of low activity in the financial and commodity markets.

In addition, a more predictable trend may emerge in which the market moves in a limited price range. This leads to market trends that can be predicted with a higher probability than in the case of larger directional movements in the markets, which creates favourable conditions for trading within a narrow market range (range trading). In this case, a higher number of profitable trades are observed for clients, leading to a reduction in the Group’s market making result.

Volatility and market activity is driven by a number of external factors, some of which are market specific and some of which may be linked to general macroeconomic conditions. It can significantly affect the Group’s revenues in subsequent quarters. This is characteristic of the Group’s business model.

Selected financial and operating data for the first half of the year at XTB follows.