XTB reports strong Q3-2022 with Revenues $83M, Profits $50M

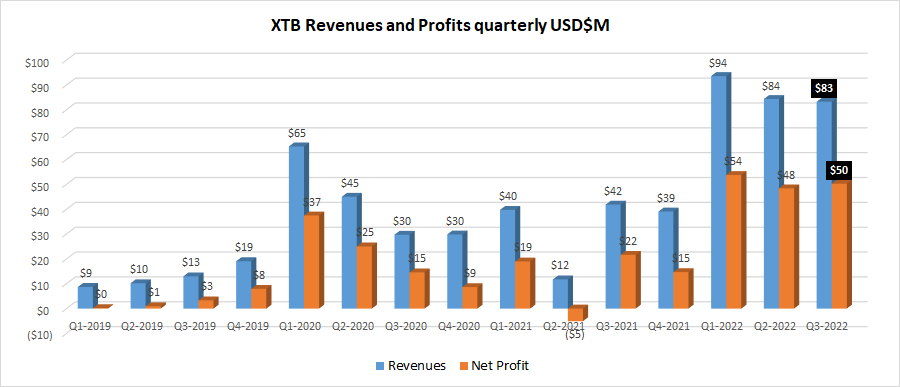

Poland based online trading group XTB S.A. (WSE:XTB) continued its strong 2022 with another good quarter in Q3-2022, with both Revenues and Profits well ahead of year-ago levels for a third consecutive quarter.

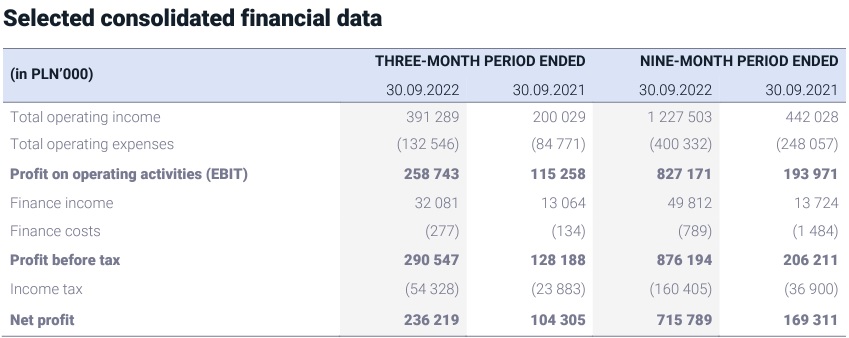

Overall, Revenues for Q3 at XTB came in at PLN 391.3M (USD $83 million), slightly down (just 1%) from PLN 396.4M in Q2. However Net Profit in Q3 increased to PLN 236.2M (USD $50M), up 4% from Q2’s PLN 227.3M.

By comparison to last year, XTB has now averaged quarterly Revenue of $87 million in the first nine months of 2022, versus just $33 million last year – up 163% YoY!

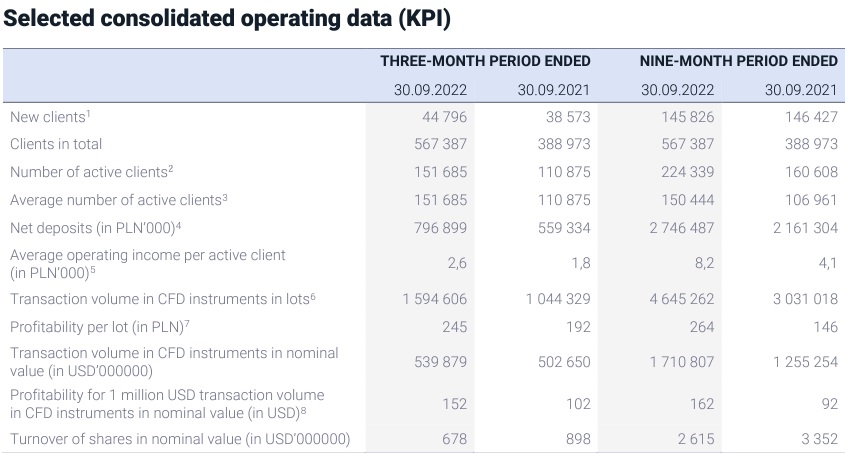

Driving the growth in financial success was another strong quarter of client CFD trading volumes, at $180 billion monthly during Q3-2022. That is fairly even with Q2 volume, and well above the $145 billion XTB averaged monthly during 2021.

XTB said that it has a solid foundation in the form of a constantly growing client base and the number of active clients. From the beginning of the year, the Group acquired 145,826 new clients compared to 146,427 a year earlier, which means a slight decrease by 0.4% mainly due to a very high base from the first quarter of 2021, while the number of active clients was record high and reached the level of 224.3 thousand compared to 160.6 thousand a year earlier, which means an increase by 39.7% y/y.

The stated ambition of the XTB Management Board in 2022 is to acquire, on average, at least 40 thousand new clients quarterly. As a result of the implemented activities, the Group acquired in the first quarter of this year 55.3 thousand new clients and in the second quarter of this year nearly 45.7 thousand new clients, while in the third quarter of this year, almost 44.8 thousand new clients. In turn, in the first 25 days of October 2022, XTB acquired 14.1 thousand new clients.

The priority of the Management Board is to further increase the client base leading to the strengthening of XTB’s market position in the world. These activities will be supported by a number of initiatives, including with the participation of new XTB brand ambassadors. In February 2022, an advertising campaign was launched with the participation of the titled martial arts competitor, the first Polish woman in the UFC organization and the champion of this organization, as well as the three-time world champion in Thai boxing – Joanna Jędrzejczyk.

In September 2022, promotional activities were launched with the participation of Conor McGregor as another XTB brand ambassador. Conor McGregor is the biggest martial arts star in the world and the best rewarded athlete according to Forbes’ list. Conor is not only a fighter, but also a successful person in business as an investor in many interesting projects.

The team of XTB ambassadors was also joined in 2022 by Iker Casillas, a former Real Madrid footballer, considered one of the best goalkeepers of all time. He is currently the Deputy Director General of the Real Madrid Foundation.

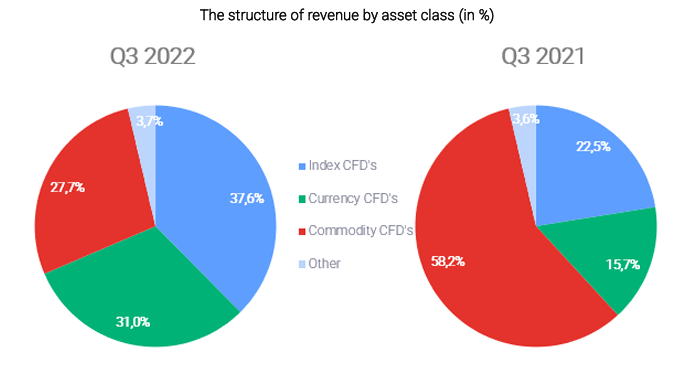

Looking at XTB’s revenues in terms of the classes of instruments, in the third quarter of 2022 CFDs based on indices were in the lead, representing 37.6% of CFD revenues. This is a consequence of high profitability on CFD instruments based on the US 100 index, Warsaw Stock Exchange index WIG20, the German DAX index (DE30) and the US 500 index. The second most profitable asset class was CFDs based on currencies. Their share in the revenue structure in the third quarter of 2022 was 31.0%. The most profitable instruments in this class were CFDs on currency pairs EURUSD, USDPLN and GBPUSD. Revenues on CFDs based on commodities accounted for 27.7% of all revenues, where the most profitable financial instruments in this class were CFDs based on gold, oil prices and natural gas prices.

Regarding international expansion, XTB said that with its strong market position and dynamically growing client base builds its presence in the non-European markets, consequently implementing a strategy on building a global brand. The XTB Management Board puts the main emphasis on organic development, on the one hand increasing the penetration of European markets, and on the other hand successively building its presence in Latin America, Asia and Africa.

Following these activities, the composition of the capital group may expanded by new subsidiaries. It is worth mentioning that geographic expansion is a process carried out by XTB on a continuous basis, the effects of which are spread over time. Therefore, one should not expect sudden, abrupt changes in the group results on this action.

Currently, the efforts of the XTB Management Board are focused on expansion into the Middle East and Africa markets. The intention of the Management Board is to start operating mid-2023 in South Africa. The development of XTB is also possible through mergers and acquisitions, especially with entities that would allow the Group to achieve geographic synergy (complementary markets). Such transactions will be carried out, only when they will bring measurable benefits for the Company and its shareholders. XTB said that it is currently not involved in any acquisition process.

Some more financial and operating data from XTB for Q3 (and nine months YTD) 2022 follows.