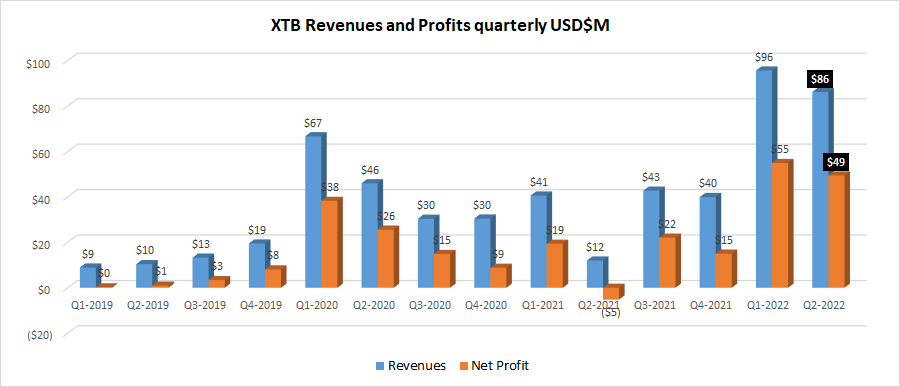

XTB continues strong 1H although Q2 Revenues down 10%, to $86M

Poland based online trading group XTB S.A. (WSE:XTB) continued its strong start to 2022 with another good quarter in Q2-2022, although activity and profitability slowed somewhat from XTB’s record Q1. The stock market seemed to welcome the news, with XTB shares trading up by about 3% in early trading Wednesday, at zł23.46 per share, setting a new 52-week high.

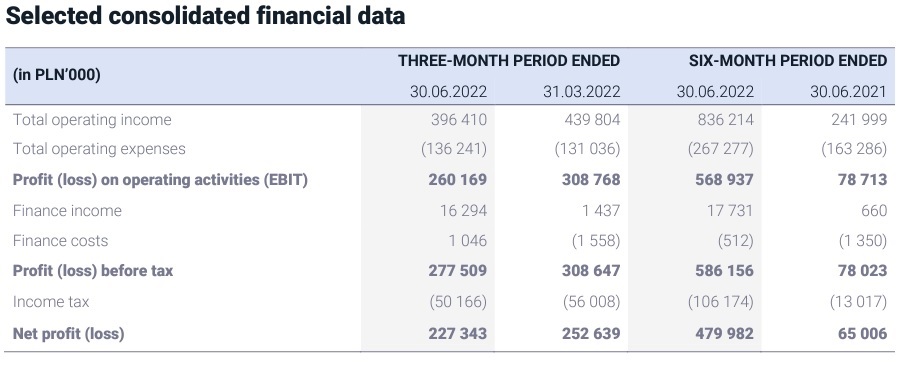

Overall, Revenues for Q2 at XTB came in at PLN 396.4M (USD $86 million), down 10% from PLN 439.8M in Q1, which as noted was a record for the company. Net profit was PLN 227.3M (USD $49M) in Q2, also off 10% from Q1’s record PLN 252.6M.

By comparison to last year, XTB averaged quarterly Revenue of $91 million in the first half of 2022, versus just $34 million last year – up 169%!

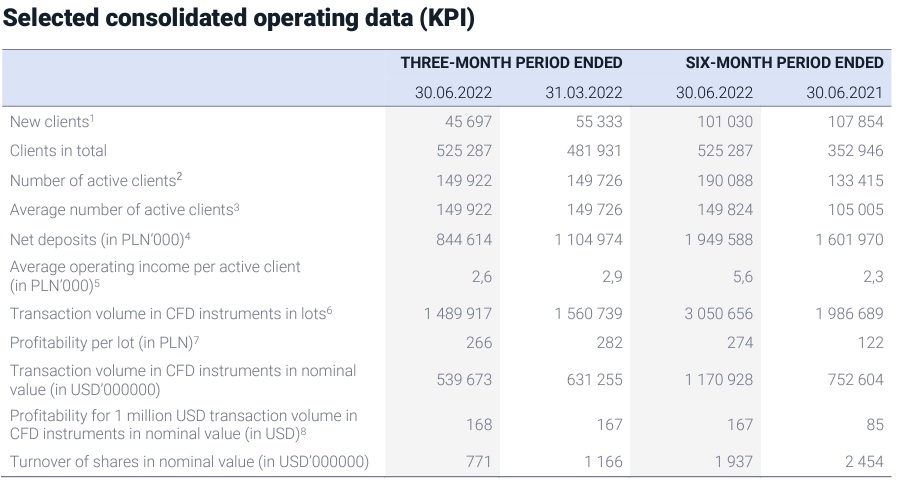

Driving the growth in financial success was another strong quarter of client CFD trading volumes, at $180 billion monthly during Q2-2022. That was down somewhat from average monthly trading volume of $210 billion on XTB.com during Q1, although well above the $145 billion XTB averaged monthly during 2021.

XTB said that it has a solid foundation in the form of a constantly growing client base and the number of active clients. In the first half of 2022 the Group acquired 101,030 new clients (Q2: 45,697) compared to 107,854 a year earlier, a slight decrease of 6.3% mainly due to a record high base from the first quarter of 2021. In the reporting period, the number of active clients was at a record high. It increased by 42.5% YoY, from 133,415 to 190,088.

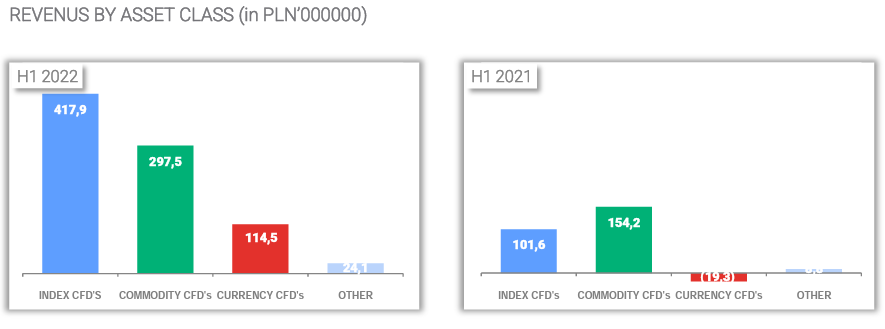

Looking at XTB’s revenues in terms of the classes of instruments, it can be seen that in the first half of 2022 CFDs based on indices were in the lead. Their share in the structure of revenues on financial instruments reached 48.9%. This is a consequence of high profitability on CFD instruments based on the US 100 index, the German DAX index (DE30), and the US 500 index. The second most profitable asset class was CFDs based on commodities. Their share in the revenue structure in the first half of 2022 was 34.8%. The most profitable instruments in this class were CFDs on natural gas, gold and oil prices.

Regarding its cost structure, XTB said that due to the dynamic development of the company, the Management Board estimates that in 2022 the total costs of operating activities may be about 50% higher than that observed in 2021. The priority of the Management Board is to further increase the client base and build a global brand. As a consequence of the implemented activities, marketing expenditures may increase in 2022 by nearly 70% compared to the previous year.

As far as international expansion goes, XTB added that with its strong market position and dynamically growing client base in European markets, the Management Board puts the main emphasis on organic development – on the one hand increasing the penetration of European markets, on the other hand successively building its presence in Latin America, Asia and Africa. Currently, the efforts of the company are focused on expansion into the Middle East and Africa markets, with the intention of starting to operate in South Africa in mid-2023.

The development of XTB is also possible through mergers and acquisitions, especially with entities that would allow the Group to achieve geographic synergy (complementary markets). Such transactions will be carried out, only when they will bring measurable benefits for the Company and its shareholders. XTB said it is currently not involved in any acquisition process.

Some more financial and operating data from XTB for Q2 and Q1 2022 follows.