XTB.com revenues hold steady in Q4-2020, but profits fall

Poland based Retail FX and CFDs brokerage house X Trade Brokers Dom Maklerski SA – operator of the XTB.com and X Open Hub brands – has released preliminary financial results for Q4 and full year 2020, showing that activity held steady in Q4 (after a slowdown in Q3 at XTB.com), but quarterly profits dropped to their lowest levels since 2019.

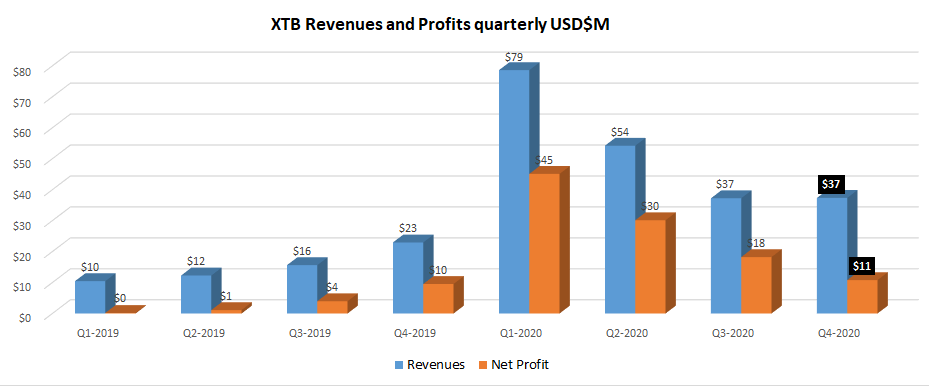

XTB.com indicated that Revenues came in at PLN 140.1 million in Q4 (USD $37 million), virtually identical to Q3’s PLN 139.6 million but still down significantly from PLN 211 million in Q2 and PLN 306 million in Q1. Q1’s record revenue of course was helped by the heightened volatility in the currency and equity markets at the outset of the COVID-19 crisis. At most brokers we have seen a decline in trading volumes and resulting revenues since Q1, but not nearly as sharp as at XTB, with Q3 and Q4 down more than 50% from Q1.

Net profit at XTB in Q4 was PLN 40.5 million (USD $11 million), down 41% from Q3’s PLN 68.4 million (USD $18 million).

In the “big picture”, however, despite the activity decline in Q3 and Q4 XTB is still well ahead of where it was in 2019, when Revenues averaged $15 million quarterly and the company was marginally profitable for most of the year.

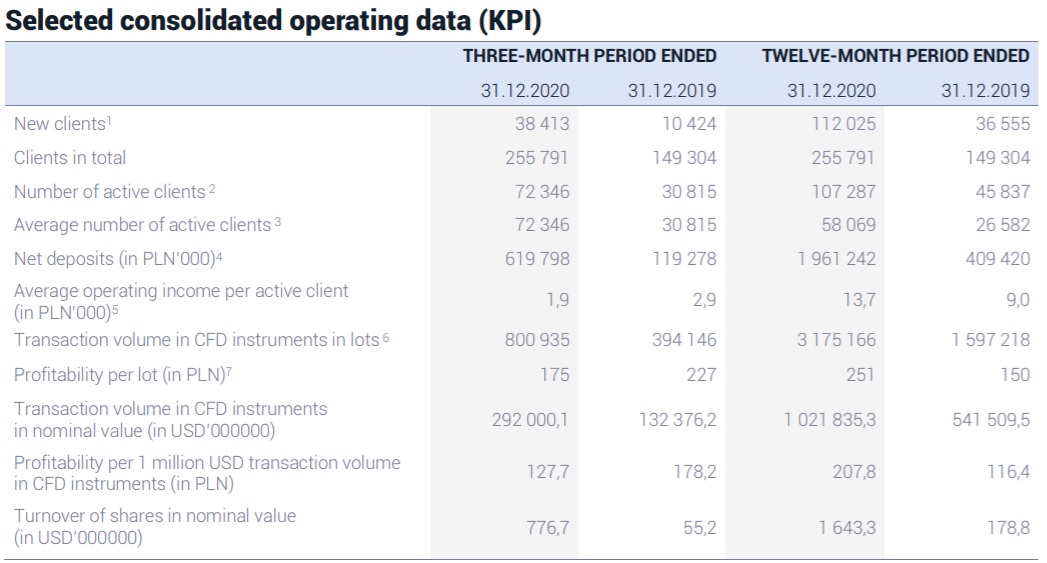

XTB.com brought on board 38,413 new clients in Q4, which was up from 21,178 new clients in Q3, boding well for future growth at the company. The average number of active clients in Q4 was 72,346, up from 55,760 in Q3.

Client net deposits in Q4 were PLN 619.8 million, more than double Q3’s PLN 296.3 million – again boding well for potential future client trading activity heading into 2021 on the XTB.com platform.

CFD trading volumes totaled USD $292.0 million in Q4, or about $97 billion monthly, which was actually up slightly from $92 billion monthly in Q3. However profitability per volume traded was down, at PLN 127.7 per million traded versus PLN 131.3 per million in Q3 (and PLN 257.9 per million in Q2).

Looking at revenue sources for the company, XTB states that CFDs based on indices dominated trading in 2020. Their share in the structure of revenues on financial instruments in 2020 reached 53.2% against 74.8% a year earlier. This is a consequence of the high interest of XTB clients in CFD instruments based on the German DAX stock index (DE30), US indices US100 and US500, and contracts based on the volatility index listed on the U.S. organized market.

The second most profitable class of assets were CFDs based on commodities. Their share in the structure of revenues on financial instruments in 2020 reached 33.0% (2019: 5.2%). The most profitable instruments among this asset class were CFD instruments based on oil prices, gold and natural gas contracts. Revenues of CFDs based on currency pairs dropped to 11.5% of all revenues, compared to 18.2% a year earlier.

XTB stated that it places great importance on the geographical diversification of revenues, consistently implementing the strategy of building a global brand. The countries from which the Group derives more than 15% of revenues are Poland and Spain with the share of 37.0% (2019: 39.9%) and 16.0% (2019: 19.9%), respectively. The share of other countries in the geographical structure of revenues does not exceed in any case 15%.

Looking forward, XTB said that it is seeking to expand internationally in 2021. The XTB Management Board puts the main emphasis on organic development, on the one hand increasing the penetration of European markets, on the other hand successively building its presence in Latin America, Asia and Africa. Currently, the Management Board efforts are focused on the start of operational activities in a chosen Asian country, i.e. the United Arab Emirates and the Republic of South Africa.

At the end of November 2020 XTB received preliminary approval of the DFSA regulator to conduct brokerage activities in the United Arab Emirates. It is an approval of the “in principal” type, that requires the fulfillment of conditions (mainly operational type) before the actual start of operations. One of the conditions was the establishment of the company XTB MENA Limited in DIFC (Dubai International Financial Centre) which took place on 9 January 2021. The process is currently underway over the fulfilment of other conditions. The intention of the Management Board is to start operating activities in United Arab Emirates in the first half of 2021.

In terms of the Republic of South Africa, due to the complex local formal and legal conditions, the Management Board is currently not able to indicate the expected date of the start of operations on this market. Subsidiary XTB Africa (PTY) has been in the licensing process since February 2019. The development of XTB is also possible through mergers and acquisitions, especially with entities that would allow the Group to achieve geographic synergy (complementary markets). Such transactions will be carried out, only when they will bring measurable benefits for the Company and its shareholders.

XTB also noted that it is currently not involved in any acquisition process.