Exclusive: Trading.com parent Trading Point sees Revenues down 78% in 2019

FNG Exclusive… FNG has learned via regulatory filings that FCA licensed Retail FX broker operator Trading Point of Financial Instruments UK Limited has seen a steep 78% decline in Revenues in 2019.

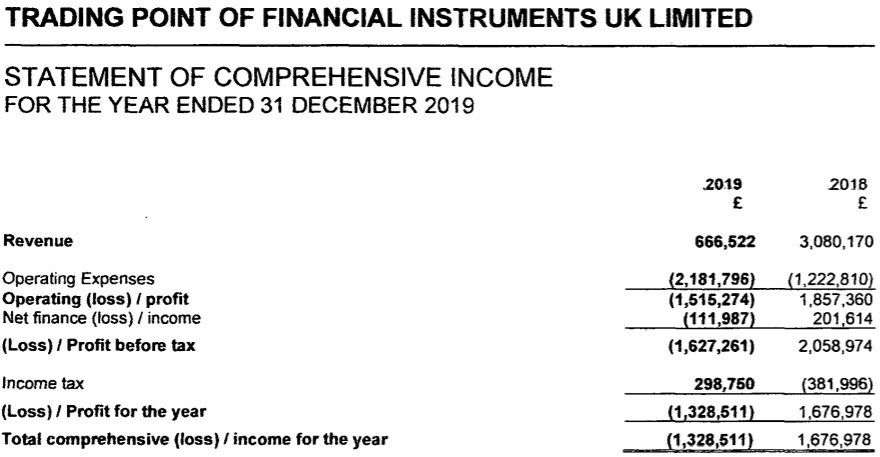

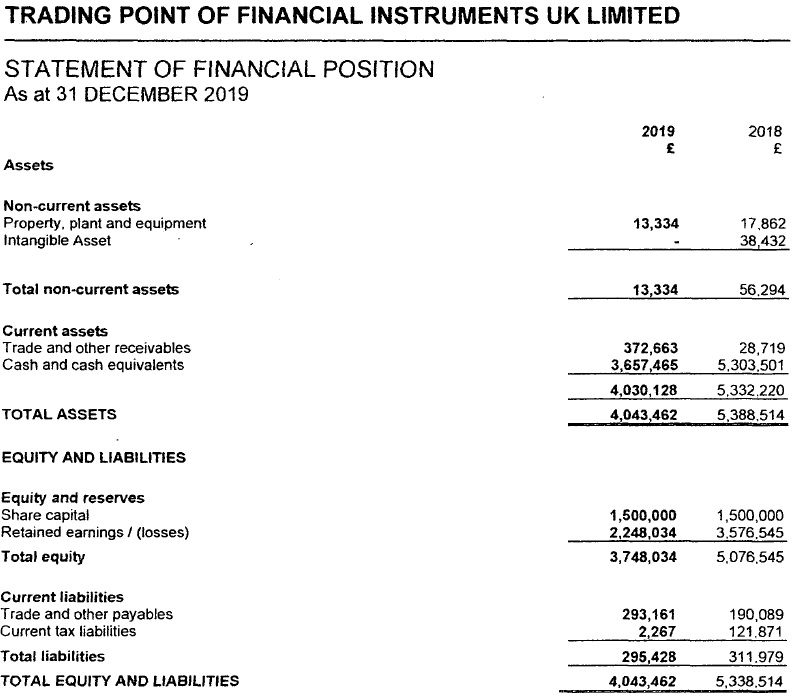

Revenues for Trading Point UK totaled £666,522 in 2019, down from £3.1 million the previous year. The company posted a loss of £1.3 million in 2019, versus a profit of £1.7 million in 2018. The decrease in the revenue figure is as a result of a decrease in the number of active clients to 4,718 in 2019 (2018: 15,074), and lower trading volumes from those clients.

Trading Point of Financial Instruments UK Limited is the UK arm of Cyprus based and CySEC-licensed Trading Point of Financial Instruments Ltd. The company said that the year 2019 was a year of change for the company. The new restrictive measures on CFD trading which were imposed in August 2018 by ESMA and were permanently adopted by the FCA in August 2019 had a material impact on the industry. These regulatory measures were the principal reason for the company’s lower trading volumes during the year.

In addition, in July 2019, the company rebranded its trading name in the UK from “XM.com” to “trading.com” which, together with a renewed marketing strategy, the company expects will help expand its client base. The group now operates the XM.com brand out of the Cyprus operation as well as offshore via XM Global Limited in Belize. (There are also licensed subsidiaries in Australia and Dubai). The trading.com brand, in addition to being used in the UK, is planned to be used for a US launch later this year, as was exclusively reported by FNG last month.

The principal activities of the company comprise the provision of online trading delivered through the company’s trading platform. Trading Point UK enables retail customers to trade global over-the-counter CFDs (Contract for Difference) on currency pairs, equities, indices and commodities markets. The company acts as the counterparty to all trades entered into by its clients. The company receives commission income from its related group entity Trading Point of Financial instruments Ltd (in Cyprus) based on the total trading volume of all its clients’ trading activity.

The company’s Net Asset position dropped to £3,748,034 as at year-end 2019 (2018: £5,076,545), and this was due to the losses incurred during the year. In addition, cash and cash equivalent also decreased to £3,657 465 (2018: £5,303,501). Management said it reviews the cash position of the company on a regular basis to ensure that it has the liquidity to operate without any external financial support.

Trading Point UK’s 2019 income statement and balance sheet follow: