Trading 212 sees Revenues and Profits rise in 2021, restructures EU operations

London and Bulgaria based online brokerage Trading 212 has released its financial statements for 2021, indicating a healthy (but modest) rise in revenues from 2020, and a more than six-fold increase in profitability.

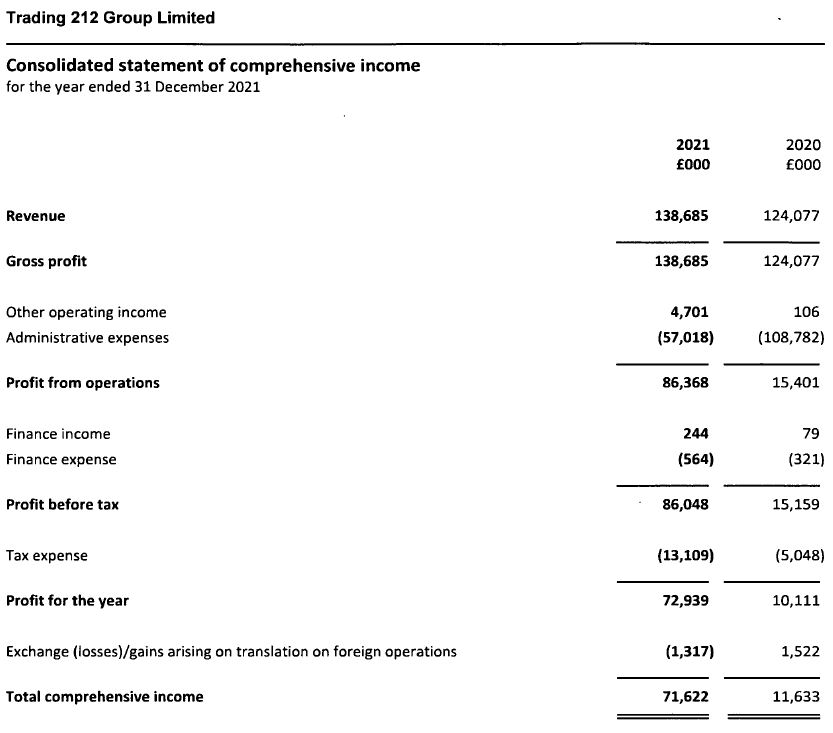

Overall, Revenues at Trading 212 came in at £138.7 million for 2021, up 12% from £124.1 million last year. We’d remind FNG readers that revenues at Trading 212 increased more than 4x last year (i.e. 2019 to 2020), as the company’s zero commission pricing structure, fractional share offering, and T212 mobile app proved to be extremely popular with the tech savvy demographic.

The bottom line was another story, with Net Profit at Trading 212 soaring from £11.6 million in 2020 to £71.6 million in 2021, as the company cut costs successfully.

Trading 212 Group Limited is a financial holding company that operates through its principal subsidiaries. As of 31st December 2021, the company had four principal subsidiaries, namely:

– Trading 212 UK Limited, registered in the United Kingdom and regulated by the Financial Conduct Authority (“T212UK”).

– Trading 212 Limited, registered in Bulgaria and regulated by the Bulgarian Financial Supervision Commission (“T212BG”).

– Trading 212 Markets Limited, registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission (“T212CY”).

– Trading 212 Europe GmbH, registered in Germany (“T212DE”). This entity is in the process of being closed.

The group’s activities (performed by the regulated entities) during the year consisted of the provision of a stock trading platform where customers can buy and sell a range of listed investments, and the provision of a Contract for Difference (“CFD”) trading service platform where two parties agree to exchange the market performance of an underlying security, currency or other financial asset through a derivative contract.

Both products are operated through Trading 212’s trading platform to clients predominantly resident in the UK and the EU.

For the stock trading business, the group operates a zero-commission model where clients do not pay commission for trading nor suffer custody fees for the assets held. T212 earns fees from clients when they trade in a currency different to that in which their cash was deposited, and through a fully collateralised stock lending programme.

There have been some structural changes made to the operation of the group during the last 12 months and these include:

– T212UK took on the market risk management of its CFD book, having previously dealt with this via a back-to-back hedging agreement with T212BG. T212UK therefore now directly manages the market risk of its open CFD positions with clients based on defined and approved risk parameters on each product and asset class, hedging exposures outside of these with reputable third parties.

– T212UK started to operate as a Systematic Internaliser (“SI”) from September 2021. This means that the entity now internalises a large volume of trades by acting in a principal capacity to customer buy and sell orders, benefitting from the bid/offer market spread in the process. Prior to this, T212UK operated by routing all orders through to appropriate counterparties.

– T212CY received regulatory approval from the Cyprus Securities and Exchange Commission on 1 March 2021. From this date, T212CY were able to onboard stock trading clients and operate as an SI, in addition to onboarding, and managing the resulting market risk of, CFD clients.

– T212BG is in the process of transitioning their clients to both T212UK and T212CY depending on their location and this will be completed in 2022.

The company aid that these structural changes were designed largely in response to Brexit.

While operating both a CFD and a stockbroking platform, T212 continues to shift focus towards stock trading with the growth strategy delivering increases in client money and asset balances. For T212UK the total increased from £2.1bn at the start of the year to £2.9bn at the end, while T212CY ended the year with £39.4m having started from £nil.

This growth has been led partly by broader market trends and activity, but also crucially by the increasing popularity of the platform and product offering which includes, for example, Trading 212’s zero commission pricing structure, the ability to trade in fractional amounts of shares, and the functionality within the platform to build portfolios. In addition, the ability to trade via T212’s mobile app has proved to be extremely popular with the tech savvy demographic.

These features have helped open share trading to a much wider and diverse client base who may not historically have had access to the financial markets or been considered as potential customers. Trading 212’s products, services and technology has facilitated and enabled a wider audience to participate in managing their own financial affairs and investment decisions that they were previously unable to do.

External factors have also contributed to the significant demand for T212’s services and include both the well-publicised surge of public interest in the stock markets seen in early 2021 as well as the longstanding COVID pandemic. This demand has translated into increased transaction volumes, customer deposits and significant increases in user activity.

With this exceptional growth came the need in early 2021 for the Board of T212UK to, voluntarily and temporarily, pause onboarding and reflect an the firm’s strategy and operating model, including the current systems, capacity, and controls in place to ensure that they remain appropriate for the size and scale of the growing business. This was also conducted with the mindset of ensuring that the firm continues to meet all regulatory obligations both today and in the future as the business continues to grow.

As a result, T212 has invested significantly in the UK entity and its operating model, and has included:

1. Increasing the share capital of the UK business by an additional £19.8m;

2. Increasing cash reserves year on year by over £80m, which supports the implementation of our improved liquidity framework;

3. The hiring of a new UK based senior management team with significant experience in this sector, including a new “C-Suite” of executives including a new CEO (Mukid Chowdhury), COO, CFO, CRO and a CTO;

4. Appointing new Directors to the UK Board, including 3 new independent non-executive Directors (2 after the year-end), which takes the total number of members on the Board to 8 Directors at the date the report was signed;

5. Significantly increasing headcount in the UK, with further approved recruitment plans to grow to circa 70; and

6. increased oversight over outsourced functions within the wider group.

The result of this investment, which continues into 2022, means that T212UK is now well positioned to provide the products, functionality and quality of service offering that our clients expect, and is now expected to accommodate future growth. T212UK started the onboarding of a limited number of customers in February 2022 and following this successful trial period, has now resumed full client onboarding, enabling Trading 212 to further contribute and support the investing public in gaining access to the wider stock markets and enabling them to take control of their financial undertakings and investment portfolios.

Trading 212 is controlled by Bulgarian entrepreneurs Borislav Nedialkov and Ivan Ashminov. The company’s 2021 income statement follows: